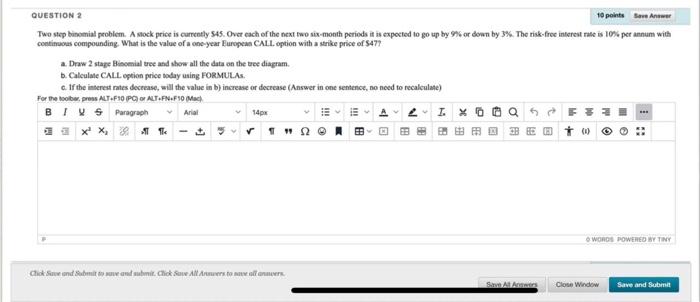

Question: QUESTION 2 10 points Save Answer Two step binomial problem. Asock price is currently s45. Over each of the next two six-month periods it is

QUESTION 2 10 points Save Answer Two step binomial problem. Asock price is currently s45. Over each of the next two six-month periods it is expected to go up by 9% or down by 3%. The risk-free interest rate is 10% per annum with continuous compounding. What is the value of a one-year European CALL option with a strike price of 5477 a Draw 2 stage Binomial tree and show all the data on the tree diagram b. Calculate CALL option price today using FORMULAS. c. If the interest rates decrease, will the value in b) increase or decrease (Answer in one sentence, no need to recalculate) For the lobor, press ALTF10 PCI O ALT.FN.F10 Mach BIVS Paragraph 14px I. QSF :: WORDS POWERED BY TINY Click Sand Submited. Click Swellerstwo SALAS Close Window Save and submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts