Question: QUESTION 2 10 points Save Answer Wright Company purchased a new piece of equipment to use in its business. The details of the purchase and

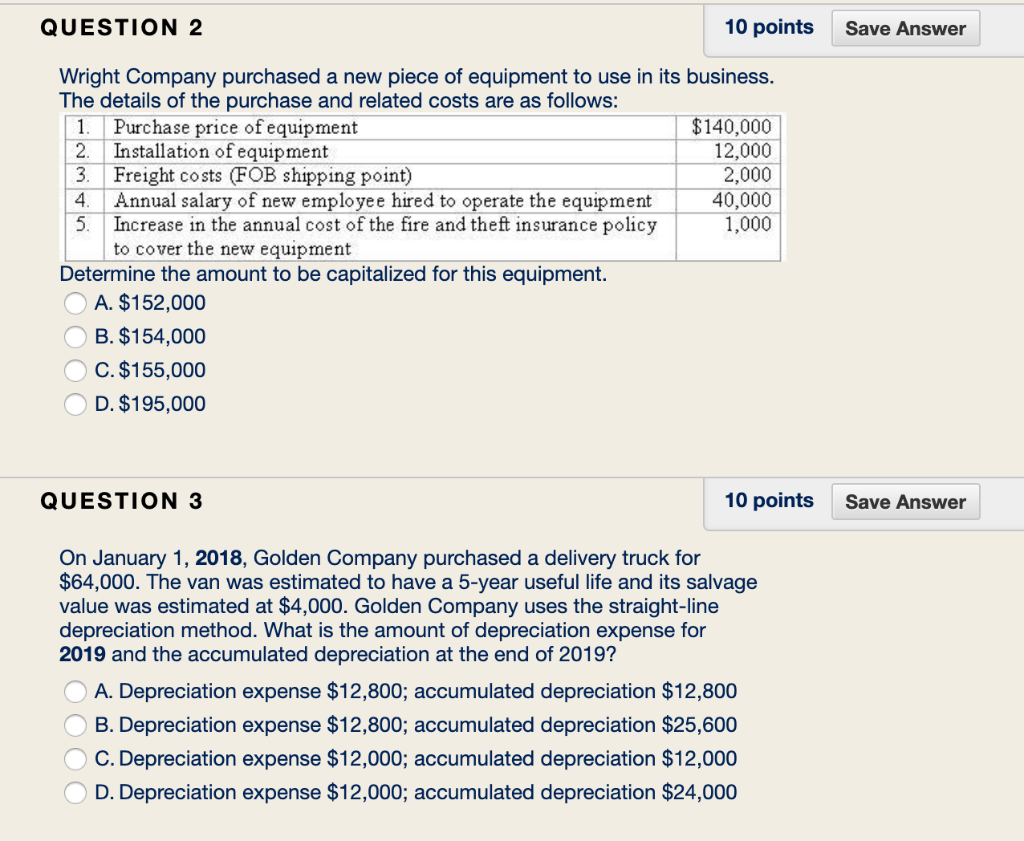

QUESTION 2 10 points Save Answer Wright Company purchased a new piece of equipment to use in its business. The details of the purchase and related costs are as follows: 1. Purchase price of equipment $140,000 2. Installation of equipment 12,000 3. Freight costs (FOB shipping point) 2,000 4. Annual salary of new employee hired to operate the equipment 40,000 5. Increase in the annual cost of the fire and theft insurance policy 1,000 to cover the new equipment Determine the amount to be capitalized for this equipment. O A. $152,000 OB. $154,000 O C. $155,000 OD. $195,000 QUESTION 3 10 points Save Answer On January 1, 2018, Golden Company purchased a delivery truck for $64,000. The van was estimated to have a 5-year useful life and its salvage value was estimated at $4,000. Golden Company uses the straight-line depreciation method. What is the amount of depreciation expense for 2019 and the accumulated depreciation at the end of 2019? A. Depreciation expense $12,800; accumulated depreciation $12,800 O B. Depreciation expense $12,800; accumulated depreciation $25,600 OC. Depreciation expense $12,000; accumulated depreciation $12,000 D. Depreciation expense $12,000; accumulated depreciation $24,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts