Question: Question 2 10 pts A compressor unit was acquired at a cost of $500,000. 175% declining-balance depreciation is applicable for this property. Calculate the depreciation

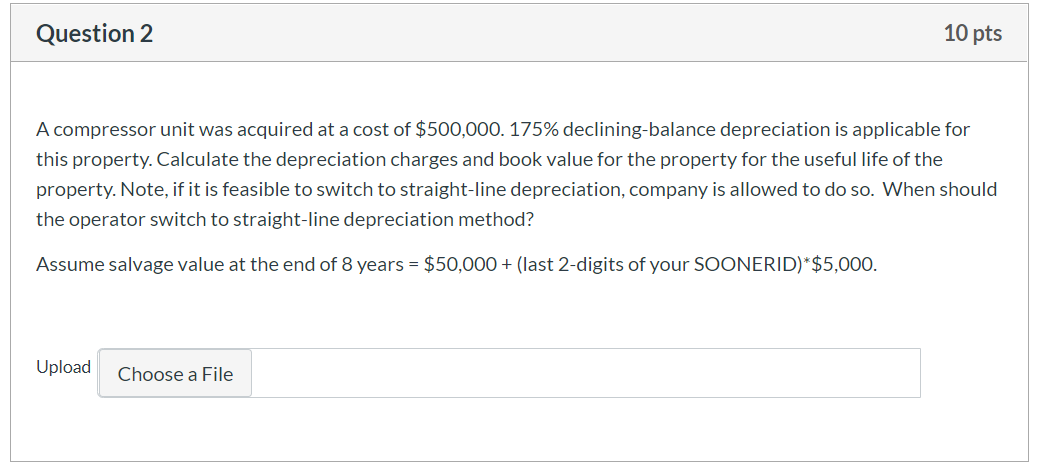

Question 2 10 pts A compressor unit was acquired at a cost of $500,000. 175% declining-balance depreciation is applicable for this property. Calculate the depreciation charges and book value for the property for the useful life of the property. Note, if it is feasible to switch to straight-line depreciation, company is allowed to do so. When should the operator switch to straight-line depreciation method? Assume salvage value at the end of 8 years = $50,000 + (last 2-digits of your SOONERID)*$5,000. Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock