Question: Question 2 (13 marks) Read the case study below and answer the questions that follow: TechStar is a medium-sized tech company that provides a range

Question 2 (13 marks)

Read the case study below and answer the questions that follow:

TechStar is a medium-sized tech company that provides a range of products and services to commercial and retail clients. You are an analyst who has been tasked with analysing the company's cash flows.

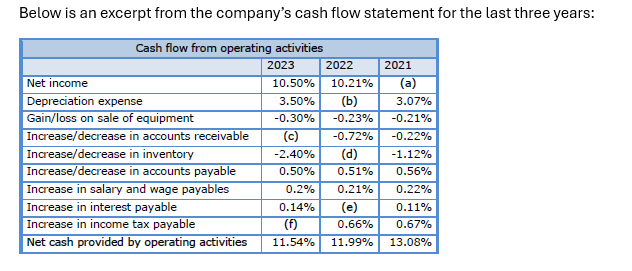

Below is an excerpt from the company's cash flow statement for the last three years: Cash flow from operating activities 2023 2022 2021 Net income 10.50% 10.21% (a) Depreciation expense 3.50% (b) 3.07% Gain/loss on sale of equipment -0.30% -0.23% -0.21% Increase/decrease in accounts receivable (c) -0.72% -0.22% Increase/decrease in inventory -2.40% (d) -1.12% Increase/decrease in accounts payable 0.50% 0.51% 0.56% Increase in salary and wage payables 0.2% 0.21% 0.22% Increase in interest payable 0.14% (e) 0.11% Increase in income tax payable (f) 0.66% 0.67% Net cash provided by operating activities 11.54% 11.99% 13.08%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts