Question: Question 2 (15 marks) a) Explain how it is possible to derive the Capital Market Line (CML) from the Efficient Frontier. (4 marks) b) Based

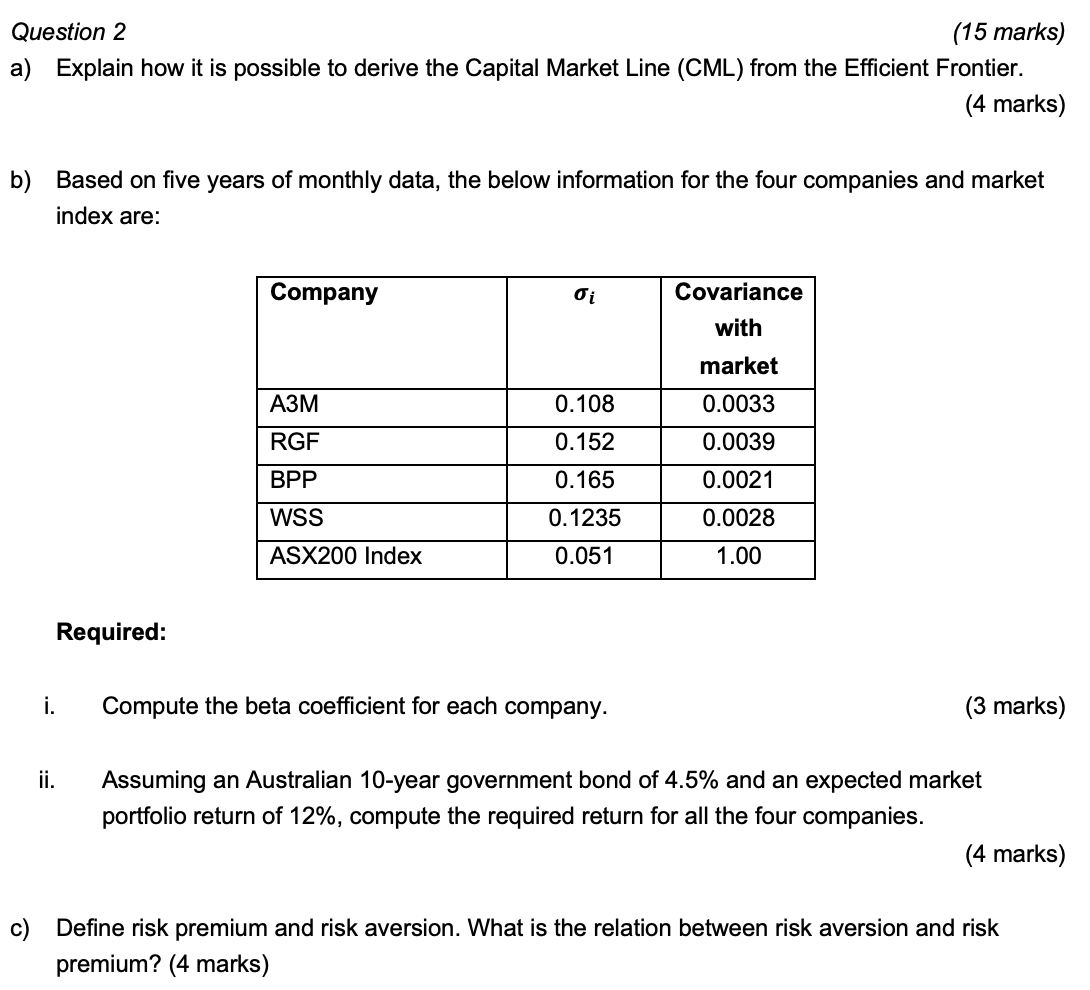

Question 2 (15 marks) a) Explain how it is possible to derive the Capital Market Line (CML) from the Efficient Frontier. (4 marks) b) Based on five years of monthly data, the below information for the four companies and market index are: Company oi Covariance with market A3M 0.108 0.0033 RGF 0.152 0.0039 BPP 0.165 0.0021 WSS 0.1235 0.0028 ASX200 Index 0.051 1.00 Required: i. Compute the beta coefficient for each company. (3 marks) ii. Assuming an Australian 10-year government bond of 4.5% and an expected market portfolio return of 12%, compute the required return for all the four companies. (4 marks) c) Define risk premium and risk aversion. What is the relation between risk aversion and risk premium? (4 marks) Question 2 (15 marks) a) Explain how it is possible to derive the Capital Market Line (CML) from the Efficient Frontier. (4 marks) b) Based on five years of monthly data, the below information for the four companies and market index are: Company oi Covariance with market A3M 0.108 0.0033 RGF 0.152 0.0039 BPP 0.165 0.0021 WSS 0.1235 0.0028 ASX200 Index 0.051 1.00 Required: i. Compute the beta coefficient for each company. (3 marks) ii. Assuming an Australian 10-year government bond of 4.5% and an expected market portfolio return of 12%, compute the required return for all the four companies. (4 marks) c) Define risk premium and risk aversion. What is the relation between risk aversion and risk premium? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts