Question: Question #2 (15 points) a) (5 points) A standard corporate bond ( $1,000 face value, semi-annual compounding) was issued exactly 12 years ago and had

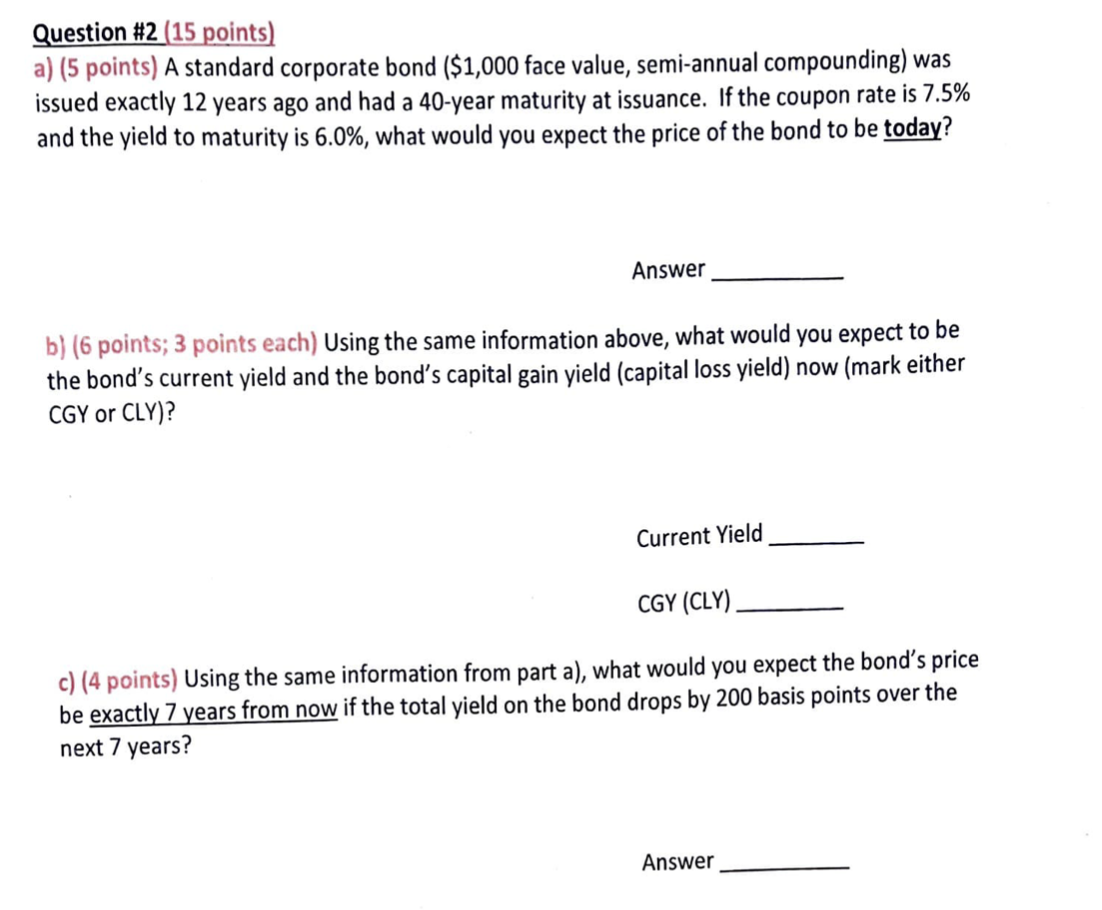

Question \#2 (15 points) a) (5 points) A standard corporate bond ( $1,000 face value, semi-annual compounding) was issued exactly 12 years ago and had a 40-year maturity at issuance. If the coupon rate is 7.5% and the yield to maturity is 6.0%, what would you expect the price of the bond to be today? Answer b) ( 6 points; 3 points each) Using the same information above, what would you expect to be the bond's current yield and the bond's capital gain yield (capital loss yield) now (mark either CGY or (LY) ? Current Yield CGY(CLY) c) (4 points) Using the same information from part a), what would you expect the bond's price be exactly 7 years from now if the total yield on the bond drops by 200 basis points over the next 7 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts