Question: Question 2 (18 points) Let R be the expected return on a risky investment and Rybe the return on a risk-free investment. The fundamental idea

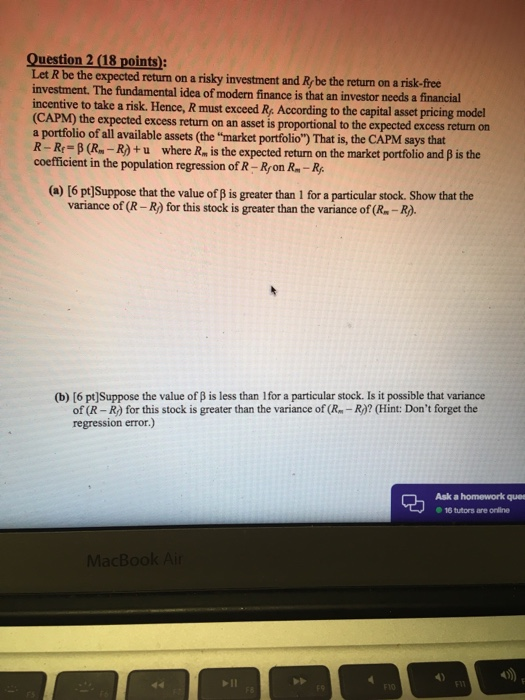

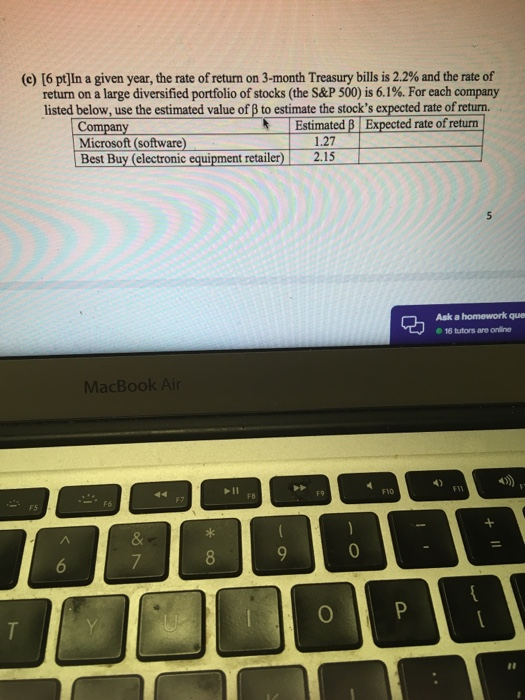

Question 2 (18 points) Let R be the expected return on a risky investment and Rybe the return on a risk-free investment. The fundamental idea of modern finance is that an investor needs a financial incentive to take a risk. Hence, R must exceed Re According to the capital asset pricing model (CAPM) the expected excess return on an asset is proportional to the expected excess return on a portfolio of all available assets (the "market portfolio") That is, the CAPM says that R-R- (Rm-R) + u where Rm is the expected return on the market portfolio and is the coefficient in the population regression of R- Ryon R-R (a) [6 pt]Suppose that the value of is greater than 1 for a particular stock. Show that the variance of (R-R) for this stock is greater than the variance of (R. -R). (b) [6 pt]Suppose the value of B is less than Ifor a particular stock. Is it possible that variance of (R -R) for this stock is greater than the variance of (R-R)? (Hint: Don't forget the regression error.) Ask a homework ques 16 tutors are online 4) F10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts