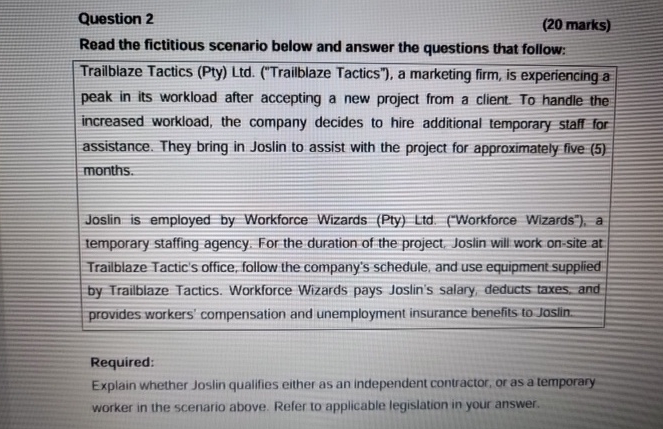

Question: Question 2 ( 2 0 marks ) Read the fictitious scenario below and answer the questions that follow: Trailblaze Tactics ( Pty ) Ltd .

Question

marks

Read the fictitious scenario below and answer the questions that follow:

Trailblaze Tactics Pty LtdTrailblaze Tactics" a marketing firm, is experiencing a peak in its workload after accepting a new project from a client. To handle the increased workload, the company decides to hire additional temporary staff for assistance. They bring in Joslin to assist with the project for approximately five months.

Joslin is employed by Workforce Wizards Pty LtdWorkforce Wizards" a temporary staffing agency. For the duration of the project Joslin will work onsite at Traiblaze Tactic's office, follow the company's schedule, and use equipment supplied by Trailblaze Tactics. Workforce Wizards pays Joslin's salary, deducts taxes, and provides workers' compensation and unemployment insurance benefits to Joslin.

Required:

Explain whether Joslin qualifies either as an independent contractor, or as a temporary worker in the scenario above. Refer to applicable legislation in your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock