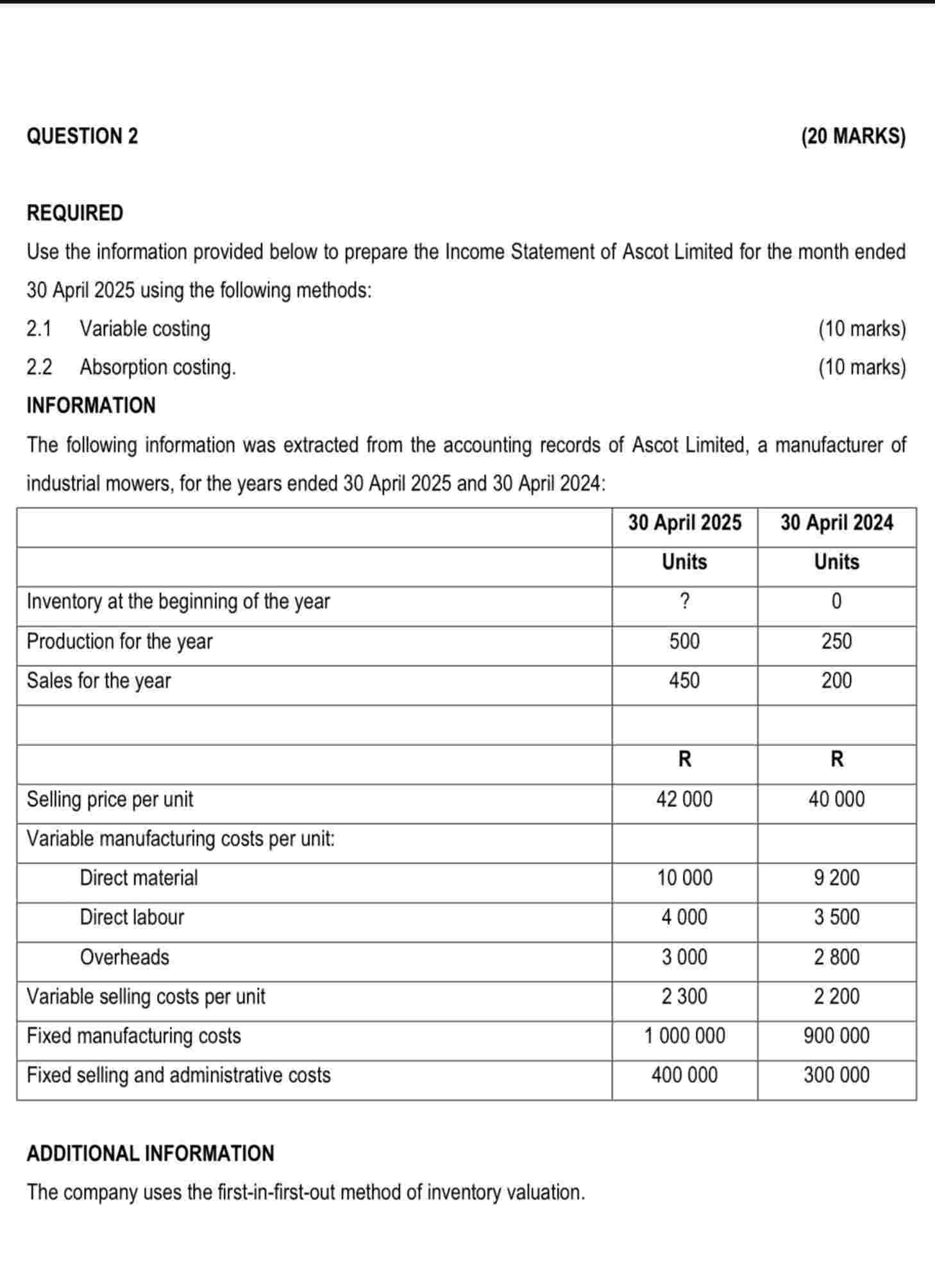

Question: QUESTION 2 ( 2 0 MARKS ) REQUIRED Use the information provided below to prepare the Income Statement of Ascot Limited for the month ended

QUESTION MARKS REQUIRED Use the information provided below to prepare the Income Statement of Ascot Limited for the month ended April using the following methods: Variable costing marks Absorption costing. marks INFORMATION The following information was extracted from the accounting records of Ascot Limited, a manufacturer of industrial mowers, for the years ended April and April : begintabularlllhline & April & April hline & Units & Units hline Inventory at the beginning of the year & & hline Production for the year & & hline Sales for the year & & hline & & hline & R & R hline Selling price per unit & & hline Variable manufacturing costs per unit: & & hline Direct material & & hline Direct labour & & hline Overheads & & hline Variable selling costs per unit & & hline Fixed manufacturing costs & & hline Fixed selling and administrative costs & & hline endtabular ADDITIONAL INFORMATION The company uses the firstinfirstout method of inventory valuation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock