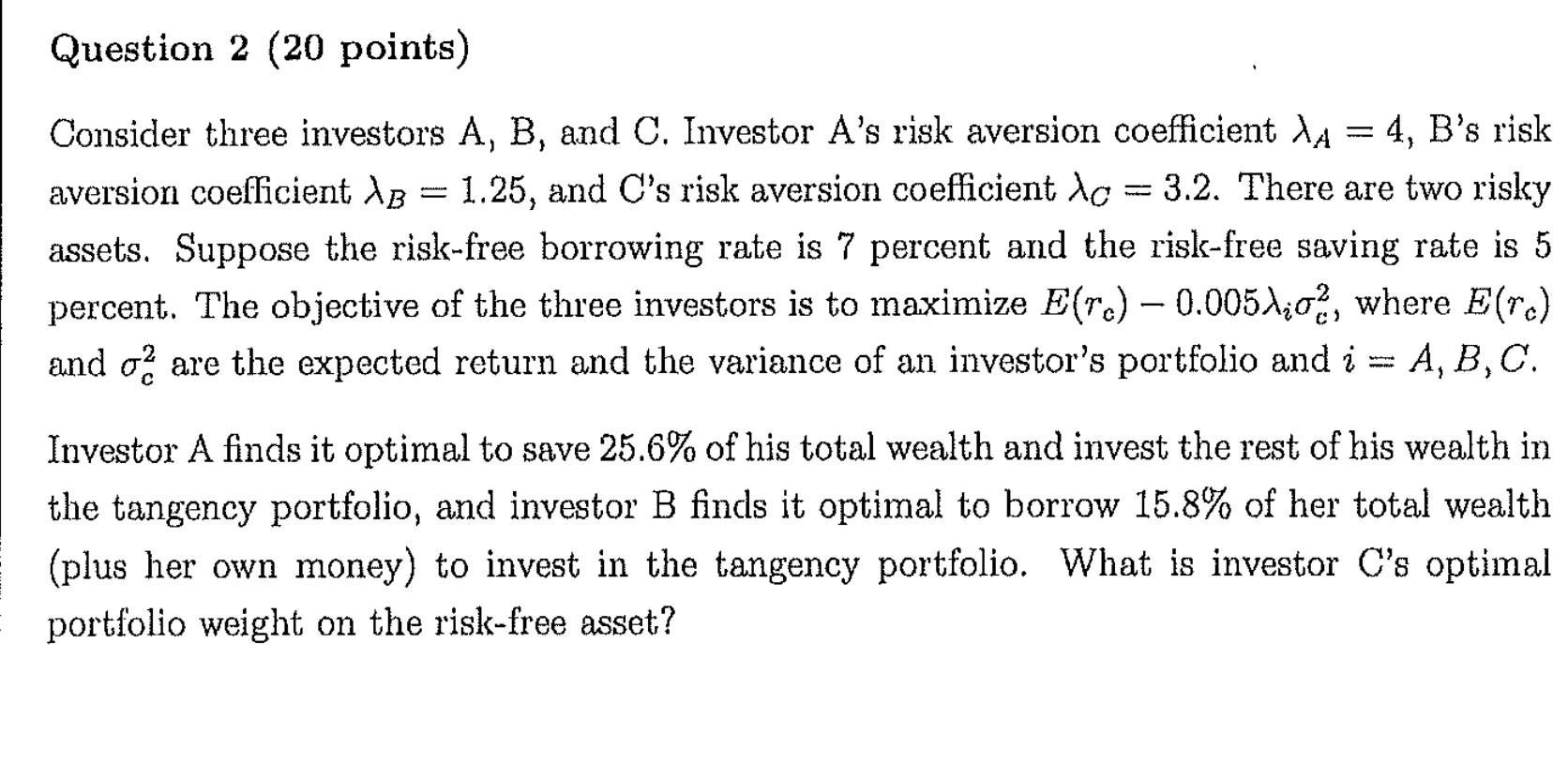

Question: Question 2 ( 2 0 points ) Consider three investors A , B , and C . Investor A ' s risk aversion coefficient A

Question points

Consider three investors and C Investor As risk aversion coefficient s risk

aversion coefficient and Cs risk aversion coefficient There are two risky

assets. Suppose the riskfree borrowing rate is percent and the riskfree saving rate is

percent. The objective of the three investors is to maximize where

and are the expected return and the variance of an investor's portfolio and

Investor A finds it optimal to save of his total wealth and invest the rest of his wealth in

the tangency portfolio, and investor B finds it optimal to borrow of her total wealth

plus her own money to invest in the tangency portfolio. What is investor Cs optimal

portfolio weight on the riskfree asset?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock