Question: Question 2 ( 2 0 points ) ( save your answer as HW 1 - Q 2 . pdf ) Suppose you are working for

Question pointssave your answer as HWQpdf

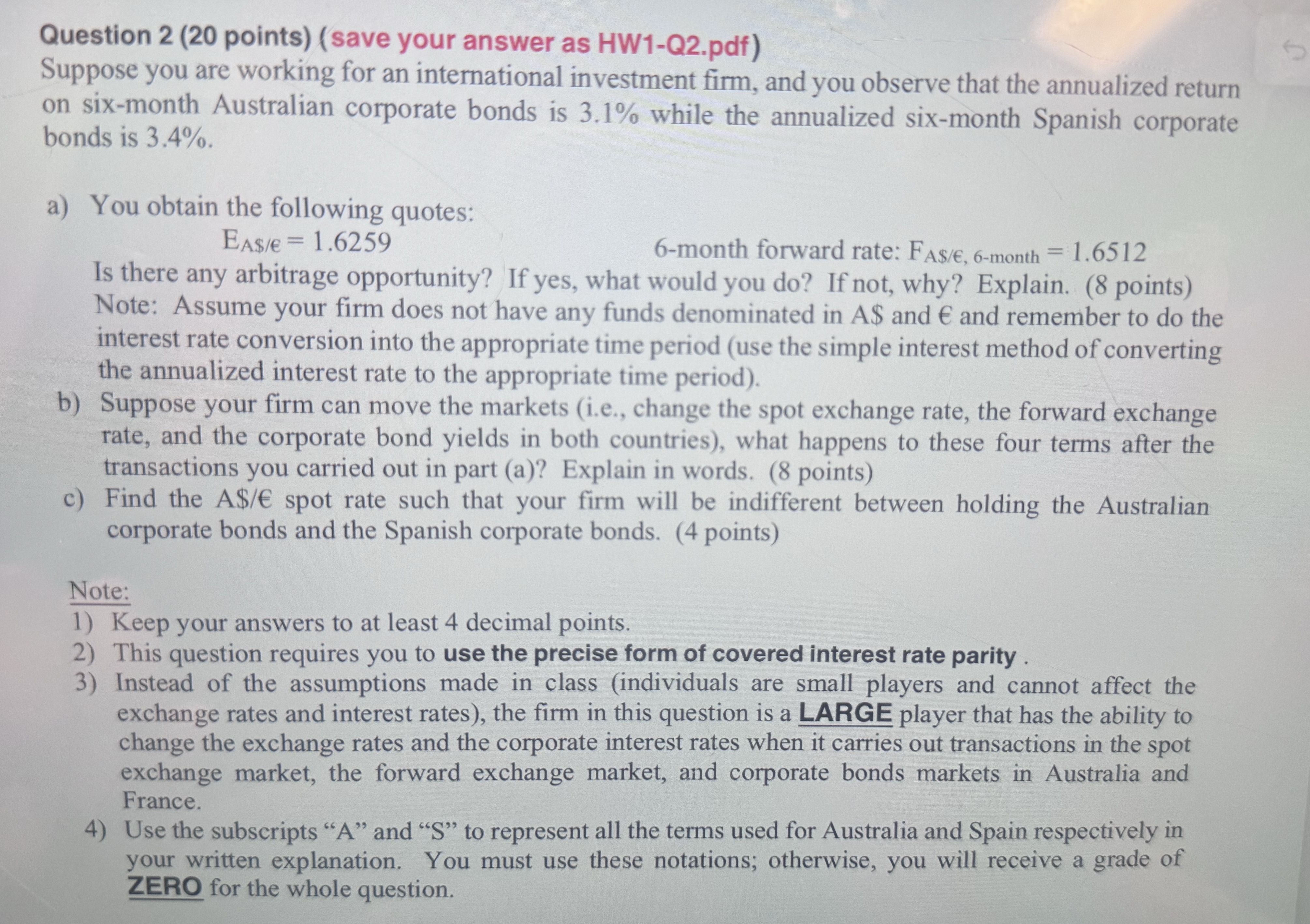

Suppose you are working for an international investment firm, and you observe that the annualized return on sixmonth Australian corporate bonds is while the annualized sixmonth Spanish corporate bonds is

a You obtain the following quotes:

month forward rate:

Is there any arbitrage opportunity? If yes, what would you do If not, why? Explain. points Note: Assume your firm does not have any funds denominated in $ and and remember to do the interest rate conversion into the appropriate time period use the simple interest method of converting the annualized interest rate to the appropriate time period

b Suppose your firm can move the markets ie change the spot exchange rate, the forward exchange rate, and the corporate bond yields in both countries what happens to these four terms after the transactions you carried out in part a Explain in words. points

c Find the spot rate such that your firm will be indifferent between holding the Australian corporate bonds and the Spanish corporate bonds. points

Note:

Keep your answers to at least decimal points.

This question requires you to use the precise form of covered interest rate parity

Instead of the assumptions made in class individuals are small players and cannot affect the exchange rates and interest rates the firm in this question is a LARGE player that has the ability to change the exchange rates and the corporate interest rates when it carries out transactions in the spot exchange market, the forward exchange market, and corporate bonds markets in Australia and France.

Use the subscripts A and S to represent all the terms used for Australia and Spain respectively in your written explanation. You must use these notations; otherwise, you will receive a grade of ZERO for the whole question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock