Question: Question 2 ( 2 5 pts ) FreshLine Foods installed a set of robotic packaging arms in their distribution center to increase efficiency in sorting

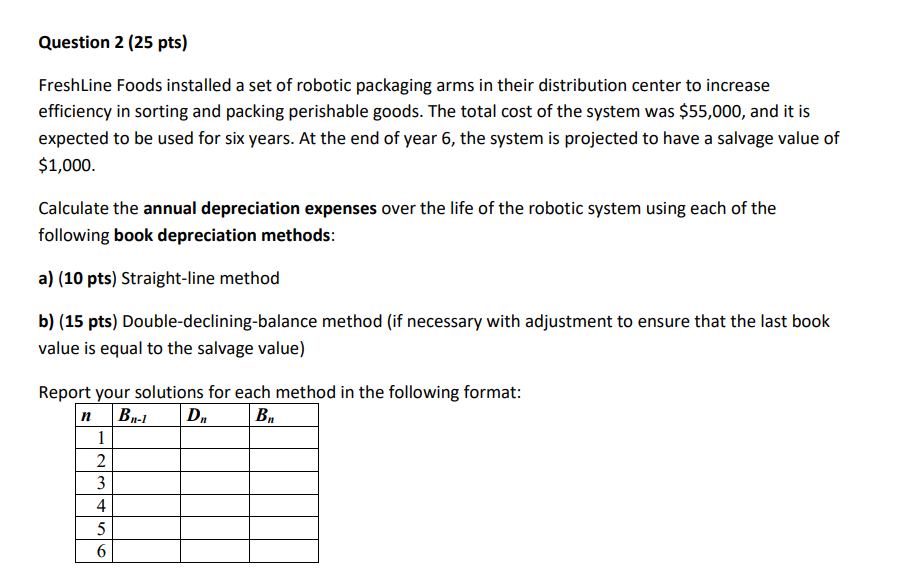

Question pts FreshLine Foods installed a set of robotic packaging arms in their distribution center to increase efficiency in sorting and packing perishable goods. The total cost of the system was $ and it is expected to be used for six years. At the end of year the system is projected to have a salvage value of $ Calculate the annual depreciation expenses over the life of the robotic system using each of the following book depreciation methods: a pts Straightline method b pts Doubledecliningbalance method if necessary with adjustment to ensure that the last book value is equal to the salvage value Report your solutions for each method in the following format:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock