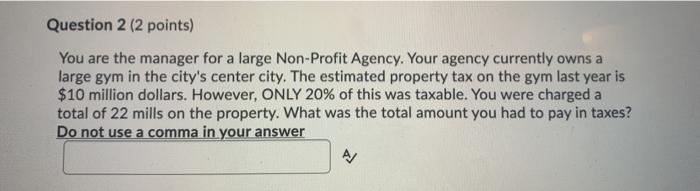

Question: Question 2 (2 points) You are the manager for a large Non-Profit Agency. Your agency currently owns a large gym in the city's center city.

Question 2 (2 points) You are the manager for a large Non-Profit Agency. Your agency currently owns a large gym in the city's center city. The estimated property tax on the gym last year is $10 million dollars. However, ONLY 20% of this was taxable. You were charged a total of 22 mills on the property. What was the total amount you had to pay in taxes? Do not use a comma in your answer A/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts