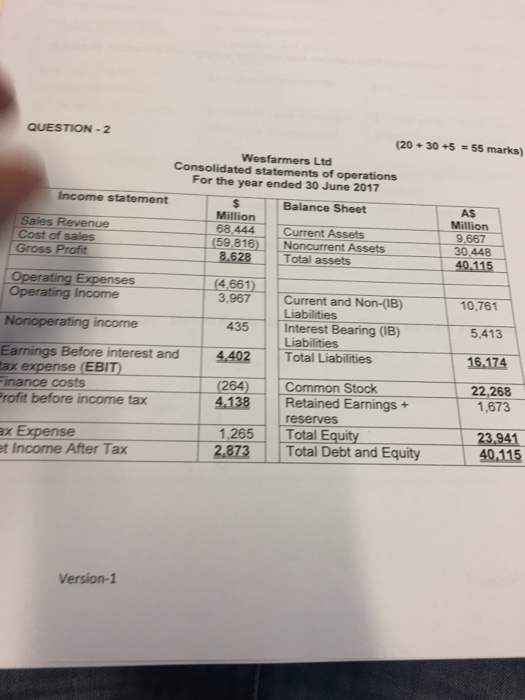

Question: QUESTION -2 (20 + 30 +5 55 marks) Wesfarmers Ltd Consolidated statements of operations For the year ended 30 June 2017 Income statement Balance Sheet

QUESTION -2 (20 + 30 +5 55 marks) Wesfarmers Ltd Consolidated statements of operations For the year ended 30 June 2017 Income statement Balance Sheet AS Million 68 444 Current Assets (59,816) Noncurrent Assets 8,628Total assets Million 9,667 30,448 Sales Revenue Cost of sales Gross Profit 40.115 ncome(4,661) 435 3,967 Current and Non-(IB) 10,761 Liabilities Interest Bearing (IB) Liabilities 5,413 income Earnings Before interest and 4402 Total Liabilities 16,174 264) |Common Stock 4.138 Retained Earnings + reserves Total Equity 22,268 inance costs rofit before income tax 1,673 23 941 Total Debt and Equity 40,115 ex Expense t Income After Tax 1,265 2,873 Version-1 a. What is the company's weighted average cost of capital using book values? Round the answer to the nearest one decimal place (20 Marks) b. Assume Wesfarmers Ltd common stock is selling at par. The market portfolio return 12%, the company beta is 1.25, and the risk premium is 8%. The companys born oommand a yield to maturity of 8 percent. At the end of the previous year, Wesfarmers's Interest-Bearing Liabilities were $5,413 Million which consist of Bonds ($ 4,000 million and Mortgage $1,413 million). The company bonds are currently trading at a price equal to 1.2 times its book value. The mortgage has 12 years remaining, with a 8% p a. interest payment (PMT) paid half-yearly. The current market interest rate for mortgage securities is10% p. a. The nan market interest company tax rate is 30%. Using the above information, recalculate the company's weighted average cost of capital using market values. Round the answer to the nearest one decimal place (30 Marks). QUESTION -2 (20 + 30 +5 55 marks) Wesfarmers Ltd Consolidated statements of operations For the year ended 30 June 2017 Income statement Balance Sheet AS Million 68 444 Current Assets (59,816) Noncurrent Assets 8,628Total assets Million 9,667 30,448 Sales Revenue Cost of sales Gross Profit 40.115 ncome(4,661) 435 3,967 Current and Non-(IB) 10,761 Liabilities Interest Bearing (IB) Liabilities 5,413 income Earnings Before interest and 4402 Total Liabilities 16,174 264) |Common Stock 4.138 Retained Earnings + reserves Total Equity 22,268 inance costs rofit before income tax 1,673 23 941 Total Debt and Equity 40,115 ex Expense t Income After Tax 1,265 2,873 Version-1 a. What is the company's weighted average cost of capital using book values? Round the answer to the nearest one decimal place (20 Marks) b. Assume Wesfarmers Ltd common stock is selling at par. The market portfolio return 12%, the company beta is 1.25, and the risk premium is 8%. The companys born oommand a yield to maturity of 8 percent. At the end of the previous year, Wesfarmers's Interest-Bearing Liabilities were $5,413 Million which consist of Bonds ($ 4,000 million and Mortgage $1,413 million). The company bonds are currently trading at a price equal to 1.2 times its book value. The mortgage has 12 years remaining, with a 8% p a. interest payment (PMT) paid half-yearly. The current market interest rate for mortgage securities is10% p. a. The nan market interest company tax rate is 30%. Using the above information, recalculate the company's weighted average cost of capital using market values. Round the answer to the nearest one decimal place (30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts