Question: Question 2 (20 marks) 1. Explain the difference between American option and European option. (2 marks) 2. Explain why it is never optimal to exercise

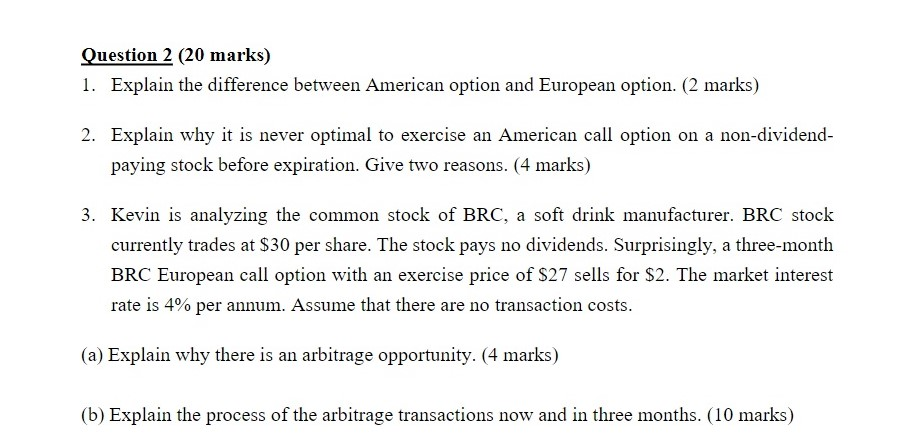

Question 2 (20 marks) 1. Explain the difference between American option and European option. (2 marks) 2. Explain why it is never optimal to exercise an American call option on a non-dividend- paying stock before expiration. Give two reasons. (4 marks) 3. Kevin is analyzing the common stock of BRC, a soft drink manufacturer. BRC stock currently trades at $30 per share. The stock pays no dividends. Surprisingly, a three-month BRC European call option with an exercise price of $27 sells for $2. The market interest rate is 4% per annum. Assume that there are no transaction costs. (a) Explain why there is an arbitrage opportunity. (4 marks) (b) Explain the process of the arbitrage transactions now and in three months. (10 marks) Question 2 (20 marks) 1. Explain the difference between American option and European option. (2 marks) 2. Explain why it is never optimal to exercise an American call option on a non-dividend- paying stock before expiration. Give two reasons. (4 marks) 3. Kevin is analyzing the common stock of BRC, a soft drink manufacturer. BRC stock currently trades at $30 per share. The stock pays no dividends. Surprisingly, a three-month BRC European call option with an exercise price of $27 sells for $2. The market interest rate is 4% per annum. Assume that there are no transaction costs. (a) Explain why there is an arbitrage opportunity. (4 marks) (b) Explain the process of the arbitrage transactions now and in three months. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts