Question: Question 2. (20 marks) (a) Helliton, Inc. has no debt outstanding and a total market value of $175,000. Earnings before interest and taxes, EBIT, are

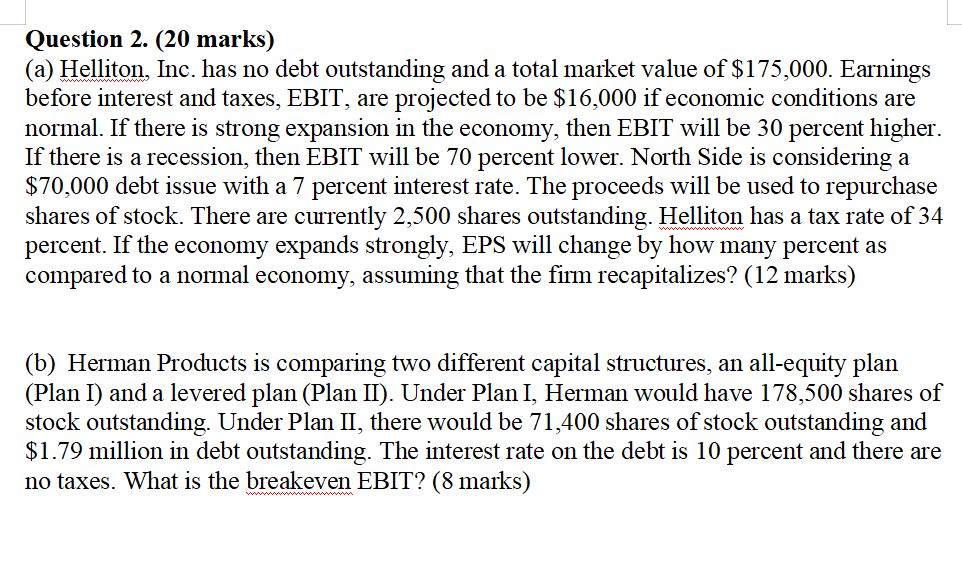

Question 2. (20 marks) (a) Helliton, Inc. has no debt outstanding and a total market value of $175,000. Earnings before interest and taxes, EBIT, are projected to be $16,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30 percent higher. If there is a recession, then EBIT will be 70 percent lower. North Side is considering a $70,000 debt issue with a 7 percent interest rate. The proceeds will be used to repurchase shares of stock. There are currently 2,500 shares outstanding. Helliton has a tax rate of 34 percent. If the economy expands strongly, EPS will change by how many percent as compared to a normal economy, assuming that the firm recapitalizes? (12 marks) (b) Herman Products is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, Herman would have 178,500 shares of stock outstanding. Under Plan II, there would be 71,400 shares of stock outstanding and $1.79 million in debt outstanding. The interest rate on the debt is 10 percent and there are no taxes. What is the breakeven EBIT? (8 marks) Question 2. (20 marks) (a) Helliton, Inc. has no debt outstanding and a total market value of $175,000. Earnings before interest and taxes, EBIT, are projected to be $16,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30 percent higher. If there is a recession, then EBIT will be 70 percent lower. North Side is considering a $70,000 debt issue with a 7 percent interest rate. The proceeds will be used to repurchase shares of stock. There are currently 2,500 shares outstanding. Helliton has a tax rate of 34 percent. If the economy expands strongly, EPS will change by how many percent as compared to a normal economy, assuming that the firm recapitalizes? (12 marks) (b) Herman Products is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, Herman would have 178,500 shares of stock outstanding. Under Plan II, there would be 71,400 shares of stock outstanding and $1.79 million in debt outstanding. The interest rate on the debt is 10 percent and there are no taxes. What is the breakeven EBIT? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts