Question: Question 2 (20 marks) DDBox Ltd. used the statement of financial position approach to estimate uncollectible account receivable. On 1 January 2023, The Allowance

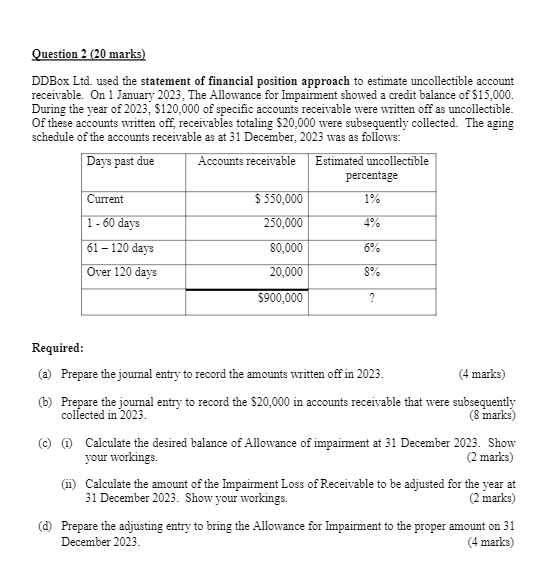

Question 2 (20 marks) DDBox Ltd. used the statement of financial position approach to estimate uncollectible account receivable. On 1 January 2023, The Allowance for Impairment showed a credit balance of $15,000. During the year of 2023, $120,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling $20,000 were subsequently collected. The aging schedule of the accounts receivable as at 31 December, 2023 was as follows: Days past due Estimated uncollectible Accounts receivable percentage Current $550,000 1% 1 - 60 days 250,000 4% 61 - 120 days 80,000 6% Over 120 days 20,000 8% $900,000 2 Required: (a) Prepare the journal entry to record the amounts written off in 2023. (4 marks) (b) Prepare the journal entry to record the $20,000 in accounts receivable that were subsequently collected in 2023. (8 marks) (c) (1) Calculate the desired balance of Allowance of impairment at 31 December 2023. Show your workings. (2 marks) (ii) Calculate the amount of the Impairment Loss of Receivable to be adjusted for the year at 31 December 2023. Show your workings. (2 marks) (d) Prepare the adjusting entry to bring the Allowance for Impairment to the proper amount on 31 December 2023. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts