Question: Question 2 Sheldon Cooper and Leonard Howard are partners in a partnership and they share in profits and losses as follows: Sheldon Cooper: 70%

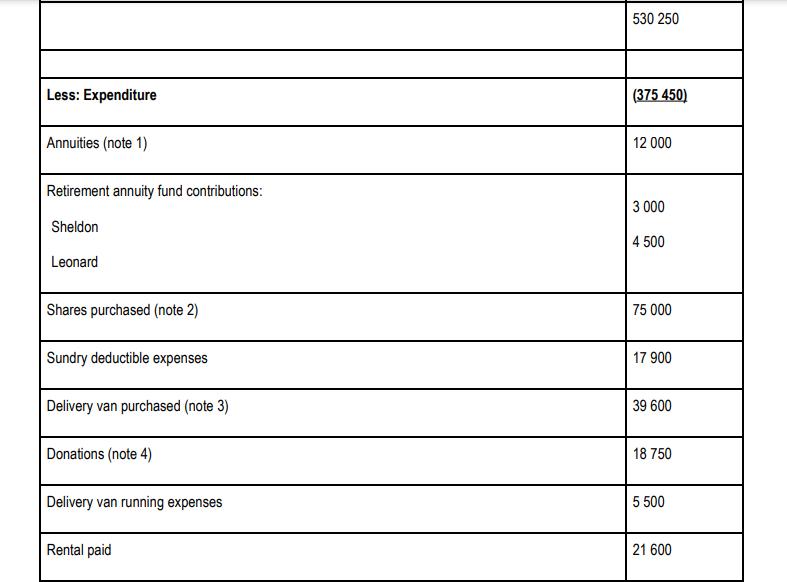

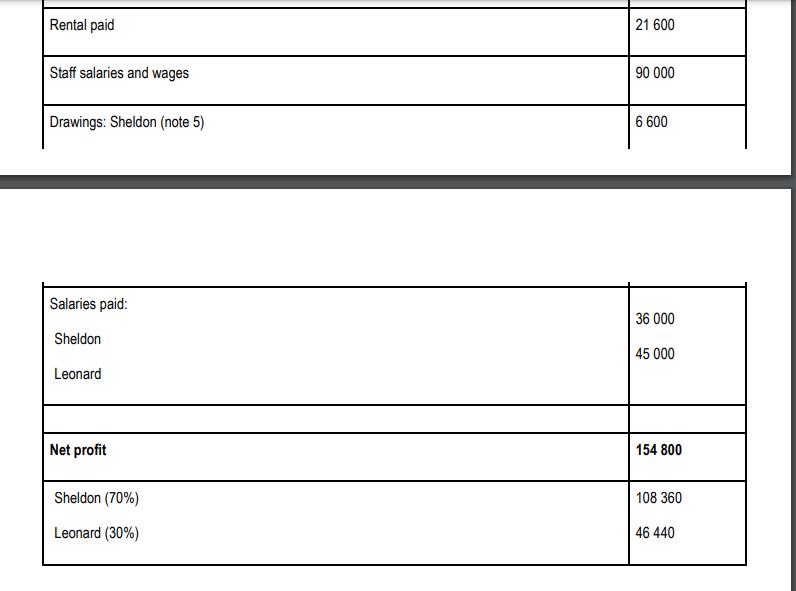

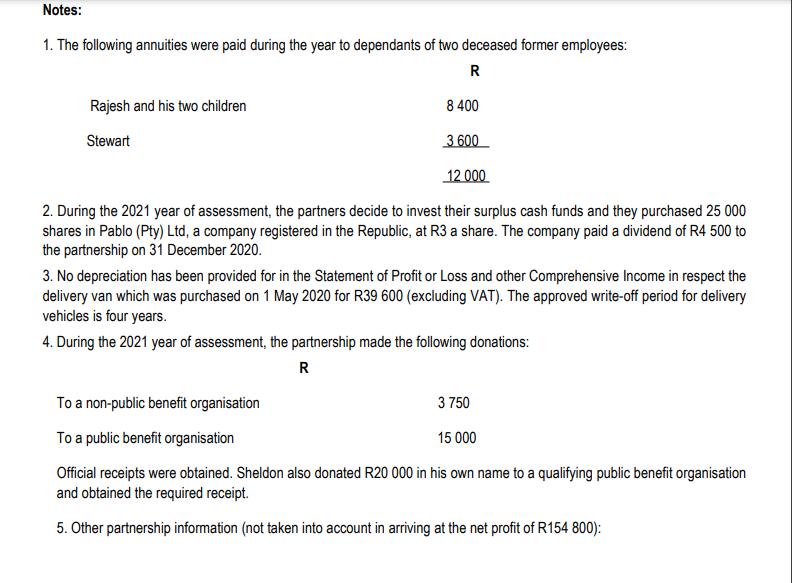

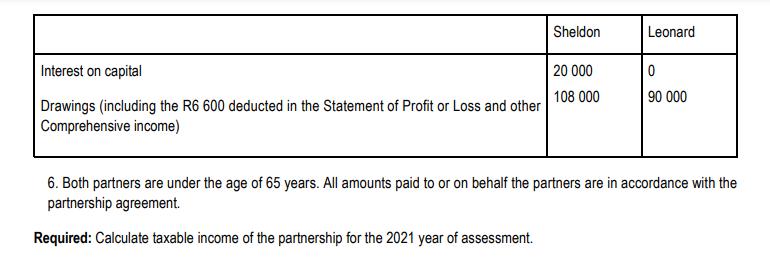

Question 2 Sheldon Cooper and Leonard Howard are partners in a partnership and they share in profits and losses as follows: Sheldon Cooper: 70% Leonard Howard: 30% The Bookkeeper has prepared and provided you with the following Statement of Profit or Loss and other Comprehensive income in respect of the partnerships 2021 year of assessment: Income Gross income Dividends received (note 2) Interest from a South African source Settlement R 500 000 4 500 (20 Marks) 6 360 19 390 Less: Expenditure Annuities (note 1) Retirement annuity fund contributions: Sheldon Leonard Shares purchased (note 2) Sundry deductible expenses Delivery van purchased (note 3) Donations (note 4) Delivery van running expenses Rental paid 530 250 (375 450) 12 000 3 000 4 500 75 000 17 900 39 600 18 750 5 500 21 600 Rental paid Staff salaries and wages Drawings: Sheldon (note 5) Salaries paid: Sheldon Leonard Net profit Sheldon (70%) Leonard (30%) 21 600 90 000 6 600 36 000 45 000 154 800 108 360 46 440 Notes: 1. The following annuities were paid during the year to dependants of two deceased former employees: R Rajesh and his two children Stewart 8 400 3.600 12 000 2. During the 2021 year of assessment, the partners decide to invest their surplus cash funds and they purchased 25 000 shares in Pablo (Pty) Ltd, a company registered in the Republic, at R3 a share. The company paid a dividend of R4 500 to the partnership on 31 December 2020. 3. No depreciation has been provided for in the Statement of Profit or Loss and other Comprehensive Income in respect the delivery van which was purchased on 1 May 2020 for R39 600 (excluding VAT). The approved write-off period for delivery vehicles is four years. 4. During the 2021 year of assessment, the partnership made the following donations: R To a non-public benefit organisation 3 750 To a public benefit organisation 15 000 Official receipts were obtained. Sheldon also donated R20 000 in his own name to a qualifying public benefit organisation and obtained the required receipt. 5. Other partnership information (not taken into account in arriving at the net profit of R154 800): Interest on capital Drawings (including the R6 600 deducted in the Statement of Profit or Loss and other Comprehensive income) Sheldon 20 000 108 000 Leonard 0 90 000 6. Both partners are under the age of 65 years. All amounts paid to or on behalf the partners are in accordance with the partnership agreement. Required: Calculate taxable income of the partnership for the 2021 year of assessment.

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Calculate taxable Income of the Pathership for the year ... View full answer

Get step-by-step solutions from verified subject matter experts