Question: Question 2 (20 points} Suppose you are working for a large, international investment bank, and you observe the annual yields on Japanese corporate bonds and

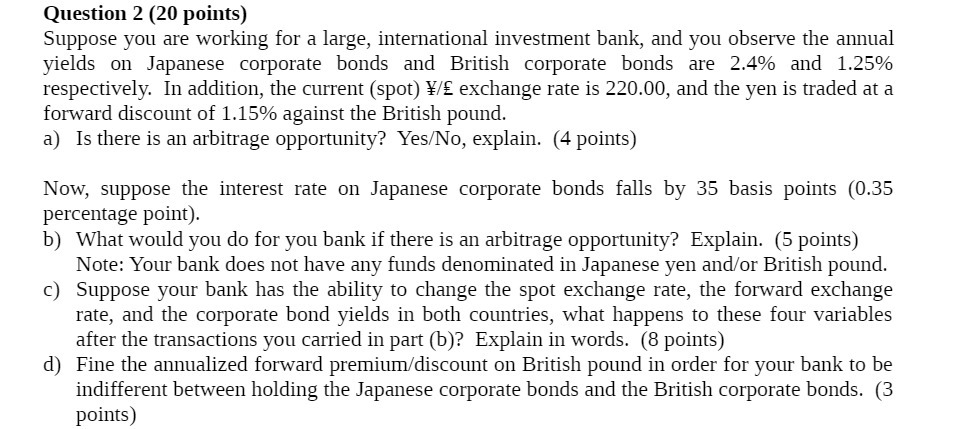

Question 2 (20 points} Suppose you are working for a large, international investment bank, and you observe the annual yields on Japanese corporate bonds and British corporate bonds are 2.4% and 1.25% respectively. In addition, the current (spot) f exchange rate is 220.00, and the yen is traded at a forward discount of 1.15% against the British pound. a) Is there is an arbitrage opportunity? YesiNo, explain. (4 points) Now, suppose the interest rate on Japanese corporate bonds falls by 35 basis points (0.35 percentage point). b) What would you do for you bank if there is an arbitrage opportunity? Explain. (5 points) Note: Your bank does not have any funds denominated in Japanese yen andfor British pound. c) Suppose your bank has the ability to change the spot exchange rate, the forward exchange rate, and The corporate bond yields in both countries, what happens to these four variables after The transactions you carried in part (b)? Explain in words. (8 points) d) Fine the annualized forward premiumfdiscount on British pound in order for your bank to be indifferent between holding the Japanese corporate bonds and the British corporate bonds. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts