Question: QUESTION 2 2.1 SimpleEat Corp. has two bond issues with information as follows (as of 2020, indicating three years until maturity). Assume that both bonds

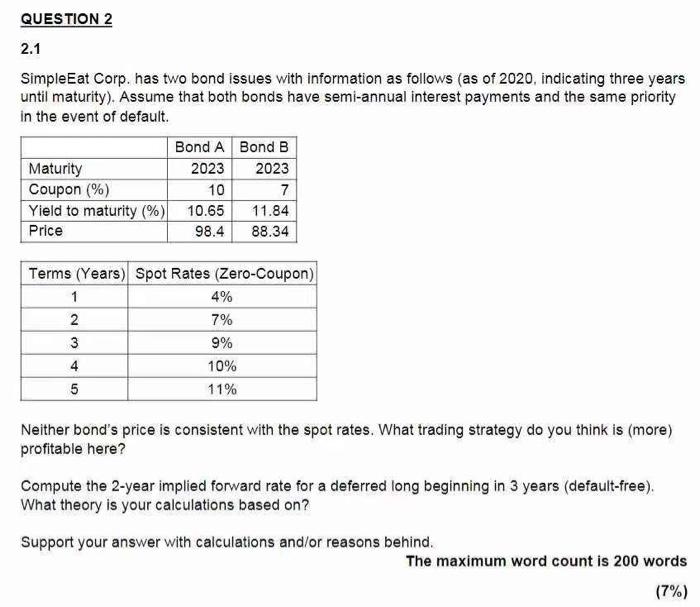

QUESTION 2 2.1 SimpleEat Corp. has two bond issues with information as follows (as of 2020, indicating three years until maturity). Assume that both bonds have semi-annual interest payments and the same priority in the event of default. Maturity Coupon (%) Yield to maturity (%) Price Bond A Bond B 2023 2023 10 7 10.65 11.84 98.4 8.34 Terms (Years) Spot Rates (Zero-Coupon) 1 4% 2 7% 3 4 10% 5 11% 9% an Neither bond's price is consistent with the spot rates. What trading strategy do you think is (more) profitable here? Compute the 2-year implied forward rate for a deferred long beginning in 3 years (default-free). What theory is your calculations based on? Support your answer with calculations and/or reasons behind. The maximum word count is 200 words (7%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts