Question: Question 2 (2+1+1+5+1= 10 marks) An engineer in a light aircraft flight company is considering two alternative types of aircraft for a 10-year project. Aircraft

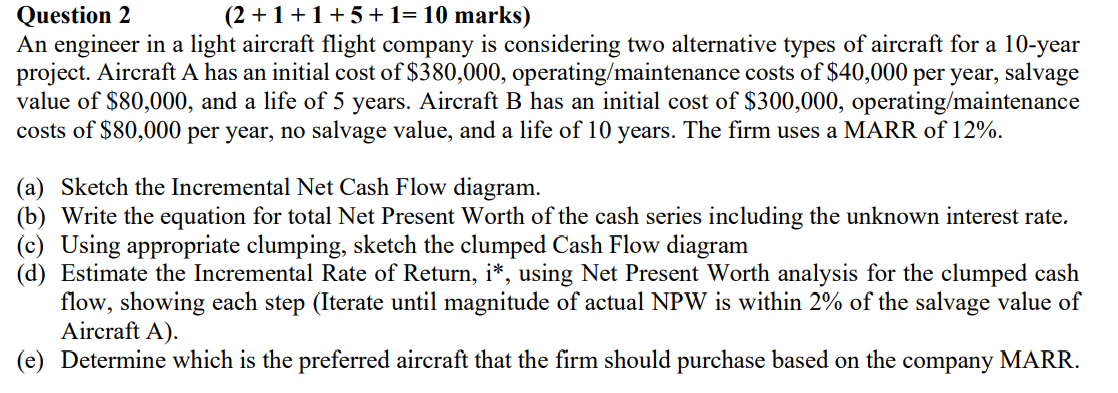

Question 2 (2+1+1+5+1= 10 marks) An engineer in a light aircraft flight company is considering two alternative types of aircraft for a 10-year project. Aircraft A has an initial cost of $380,000, operating/maintenance costs of $40,000 per year, salvage value of $80,000, and a life of 5 years. Aircraft B has an initial cost of $300,000, operating/maintenance costs of $80,000 per year, no salvage value, and a life of 10 years. The firm uses a MARR of 12%. (a) Sketch the Incremental Net Cash Flow diagram. (b) Write the equation for total Net Present Worth of the cash series including the unknown interest rate. (c) Using appropriate clumping, sketch the clumped Cash Flow diagram (d) Estimate the Incremental Rate of Return, i*, using Net Present Worth analysis for the clumped cash flow, showing each step (Iterate until magnitude of actual NPW is within 2% of the salvage value of Aircraft A). (e) Determine which is the preferred aircraft that the firm should purchase based on the company MARR. Question 2 (2+1+1+5+1= 10 marks) An engineer in a light aircraft flight company is considering two alternative types of aircraft for a 10-year project. Aircraft A has an initial cost of $380,000, operating/maintenance costs of $40,000 per year, salvage value of $80,000, and a life of 5 years. Aircraft B has an initial cost of $300,000, operating/maintenance costs of $80,000 per year, no salvage value, and a life of 10 years. The firm uses a MARR of 12%. (a) Sketch the Incremental Net Cash Flow diagram. (b) Write the equation for total Net Present Worth of the cash series including the unknown interest rate. (c) Using appropriate clumping, sketch the clumped Cash Flow diagram (d) Estimate the Incremental Rate of Return, i*, using Net Present Worth analysis for the clumped cash flow, showing each step (Iterate until magnitude of actual NPW is within 2% of the salvage value of Aircraft A). (e) Determine which is the preferred aircraft that the firm should purchase based on the company MARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts