Question: Question 2 (25 marks) (a) There are five (5) maturity strategies that the bank can employ to manage their investments portfolio. Explain with a diagram

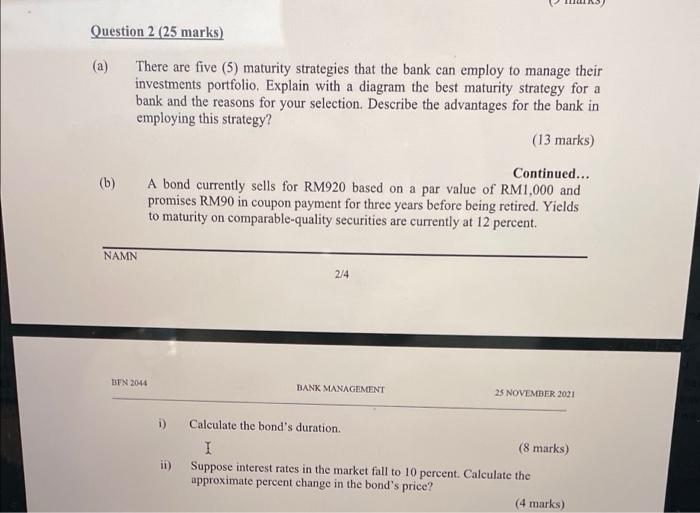

Question 2 (25 marks) (a) There are five (5) maturity strategies that the bank can employ to manage their investments portfolio. Explain with a diagram the best maturity strategy for a bank and the reasons for your selection. Describe the advantages for the bank in employing this strategy? (13 marks) Continued... A bond currently sells for RM920 based on a par value of RM1,000 and promises RM90 in coupon payment for three years before being retired. Yields to maturity on comparable-quality securities are currently at 12 percent. (b) NAMN 2/4 BFN 2044 BANK MANAGEMENT 25 NOVEMBER 2021 1) it) Calculate the bond's duration I (8 marks) Suppose interest rates in the market fall to 10 percent. Calculate the approximate percent change in the bond's price? (4 marks) Question 2 (25 marks) (a) There are five (5) maturity strategies that the bank can employ to manage their investments portfolio. Explain with a diagram the best maturity strategy for a bank and the reasons for your selection. Describe the advantages for the bank in employing this strategy? (13 marks) Continued... A bond currently sells for RM920 based on a par value of RM1,000 and promises RM90 in coupon payment for three years before being retired. Yields to maturity on comparable-quality securities are currently at 12 percent. (b) NAMN 2/4 BFN 2044 BANK MANAGEMENT 25 NOVEMBER 2021 1) it) Calculate the bond's duration I (8 marks) Suppose interest rates in the market fall to 10 percent. Calculate the approximate percent change in the bond's price? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts