Question: QUESTION 2 (25 MARKS) RM AMN Sdn. Bhd. operates a quite successful chain of milk products and tea houses across Selangor, Malaysia. AMN plans to

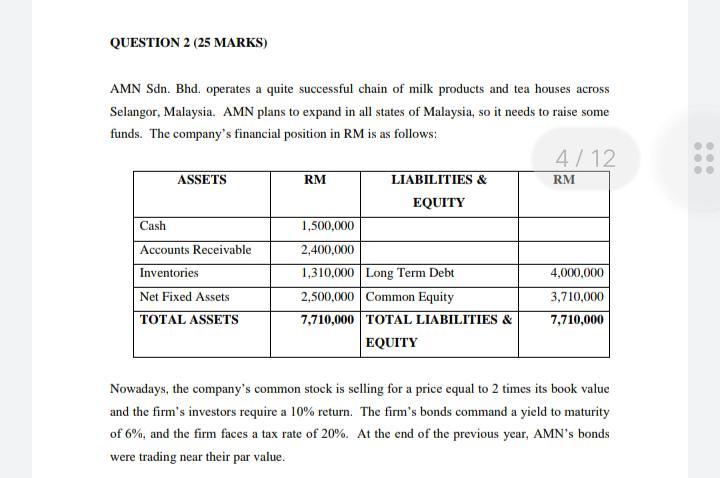

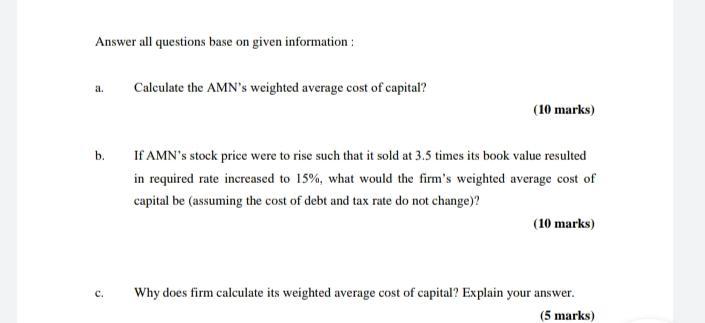

QUESTION 2 (25 MARKS) RM AMN Sdn. Bhd. operates a quite successful chain of milk products and tea houses across Selangor, Malaysia. AMN plans to expand in all states of Malaysia, so it needs to raise some funds. The company's financial position in RM is as follows: 4/12 ASSETS LIABILITIES & RM EQUITY Cash 1,500,000 Accounts Receivable 2,400,000 Inventories 1,310,000 Long Term Debt 4,000,000 Net Fixed Assets 2,500,000 Common Equity 3,710,000 TOTAL ASSETS 7,710,000 TOTAL LIABILITIES & 7,710,000 EQUITY Nowadays, the company's common stock is selling for a price equal to 2 times its book value and the firm's investors require a 10% return. The firm's bonds command a yield to maturity of 6%, and the firm faces a tax rate of 20%. At the end of the previous year, AMN's bonds were trading near their par value. Answer all questions base on given information: Calculate the AMN's weighted average cost of capital? (10 marks) b. If AMN's stock price were to rise such that it sold at 3.5 times its book value resulted in required rate increased to 15%, what would the firm's weighted average cost of capital be (assuming the cost of debt and tax rate do not change)? (10 marks) c. Why does firm calculate its weighted average cost of capital? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts