Question: PURPOSE To evaluate, analyze and calculate commonly used ratios relating to a company's profitability liquidity, solvency and management efficiency REQUIREMENT 1. Complete the balance sheet

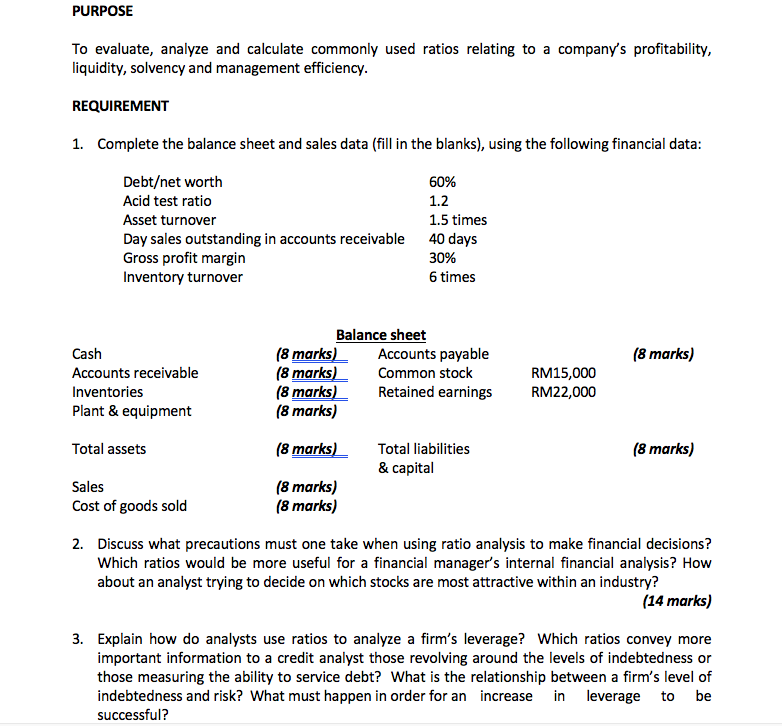

PURPOSE To evaluate, analyze and calculate commonly used ratios relating to a company's profitability liquidity, solvency and management efficiency REQUIREMENT 1. Complete the balance sheet and sales data (fill in the blanks), using the following financial data Debtet worth Acid test ratio Asset turnover Day sales outstanding in accounts receivable Gross profit margin Inventory turnover 60% 1.2 1.5 times 40 day 30% 6 times Balance sheet (8 marks) Cash Accounts receivable Inventories Plant & equipment (8 marks) Accounts payable (8 marks)Common stock (8 marks) Retained earnings (8 marks) RM15,000 RM22,000 Total assets (8 marks)Total liabilities (8 marks) & capital Sales (8 marks) (8 marks) Cost of goods sold 2. Discuss what precautions must one take when using ratio analysis to make financial decisions? Which ratios would be more useful for a financial manager's internal financial analysis? How about an analyst trying to decide on which stocks are most attractive within an industry? (14 marks,) 3. Explain how do analysts use ratios to analyze a firm's leverage? Which ratios convey more important information to a credit analyst those revolving around the levels of indebtedness or those measuring the ability to service debt? What is the relationship between a firm's level of indebtedness and risk? What must happen in order for an increase in leverage to be successful

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts