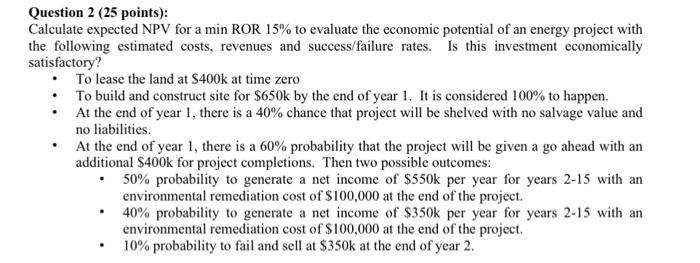

Question: Question 2 (25 points): Calculate expected NPV for a min ROR 15% to evaluate the economic potential of an energy project with the following estimated

Question 2 (25 points): Calculate expected NPV for a min ROR 15% to evaluate the economic potential of an energy project with the following estimated costs, revenues and success/failure rates. Is this investment economically satisfactory? To lease the land at $400k at time zero To build and construct site for $650k by the end of year 1. It is considered 100% to happen. At the end of year 1, there is a 40% chance that project will be shelved with no salvage value and no liabilities. At the end of year 1, there is a 60% probability that the project will be given a go ahead with an additional $400k for project completions. Then two possible outcomes: 50% probability to generate a net income of $550k per year for years 2-15 with an environmental remediation cost of $100,000 at the end of the project. 40% probability to generate a net income of $350k per year for years 2-15 with an environmental remediation cost of $100,000 at the end of the project, 10% probability to fail and sell at $350k at the end of year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts