Question: Question 2 (2.5 points) Mutually exclusive capital budgeting projects A and B have similar outlays, but different pattern of future cash flows. The required rate

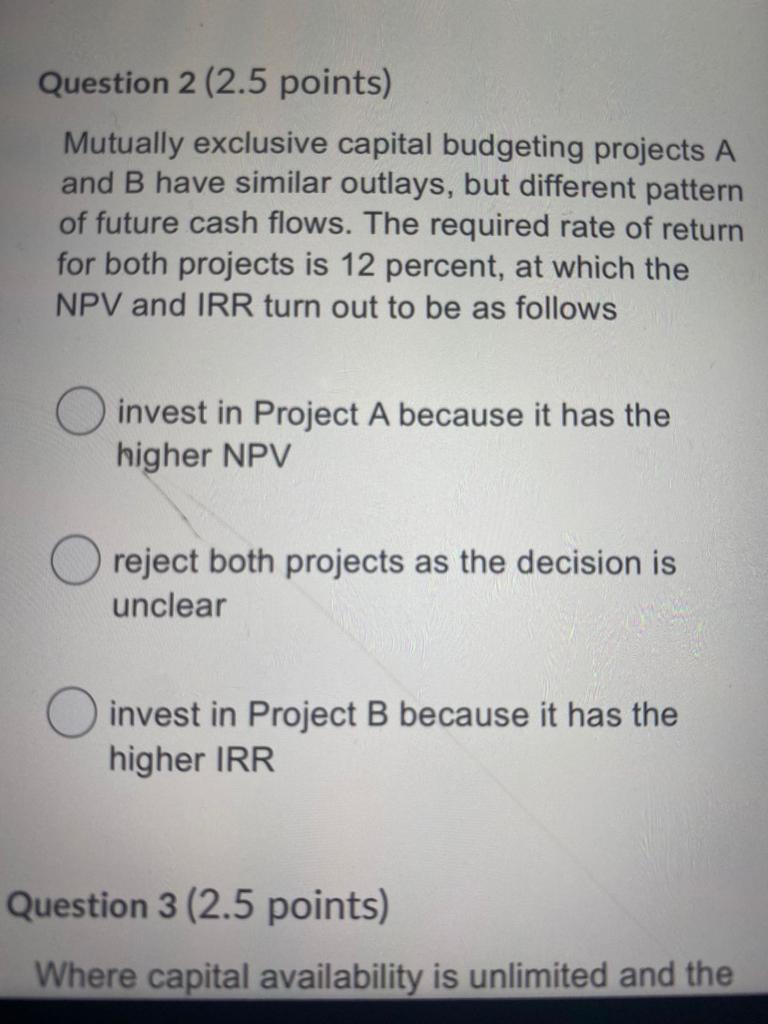

Question 2 (2.5 points) Mutually exclusive capital budgeting projects A and B have similar outlays, but different pattern of future cash flows. The required rate of return for both projects is 12 percent, at which the NPV and IRR turn out to be as follows invest in Project A because it has the higher NPV reject both projects as the decision is unclear invest in Project B because it has the higher IRR Question 3 (2.5 points) Where capital availability is unlimited and the Question 2 (2.5 points) Mutually exclusive capital budgeting projects A and B have similar outlays, but different pattern of future cash flows. The required rate of return for both projects is 12 percent, at which the NPV and IRR turn out to be as follows invest in Project A because it has the higher NPV reject both projects as the decision is unclear invest in Project B because it has the higher IRR Question 3 (2.5 points) Where capital availability is unlimited and the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts