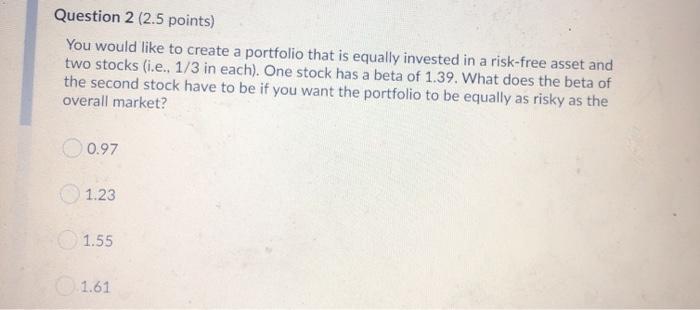

Question: Question 2 (2.5 points) You would like to create a portfolio that is equally invested in a risk-free asset and two stocks (i.e., 1/3 in

Question 2 (2.5 points) You would like to create a portfolio that is equally invested in a risk-free asset and two stocks (i.e., 1/3 in each). One stock has a beta of 1.39. What does the beta of the second stock have to be if you want the portfolio to be equally as risky as the overall market? 0.97 1.23 1.55 1.61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts