Question: Question 2 3 pts When calculating WACC, what best describes an important adjustment that has to be made to the cost of capital to properly

Question

pts

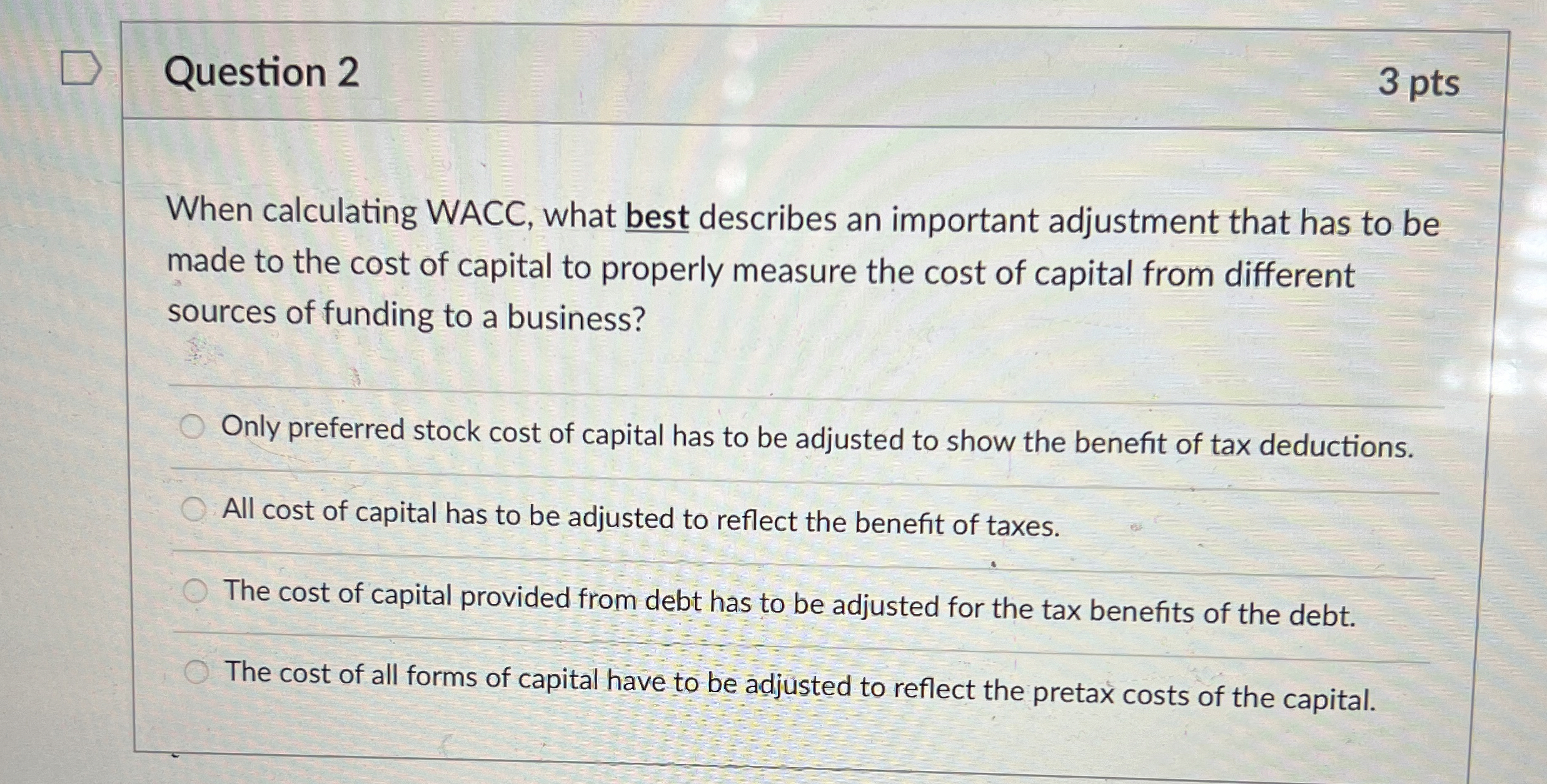

When calculating WACC, what best describes an important adjustment that has to be made to the cost of capital to properly measure the cost of capital from different sources of funding to a business?

Only preferred stock cost of capital has to be adjusted to show the benefit of tax deductions.

All cost of capital has to be adjusted to reflect the benefit of taxes.

The cost of capital provided from debt has to be adjusted for the tax benefits of the debt.

The cost of all forms of capital have to be adjusted to reflect the pretax costs of the capital.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock