Question: Question 2. (30 marks) Suppose that you are a UK investment analyst working on a short report on whether it is recommended for UK

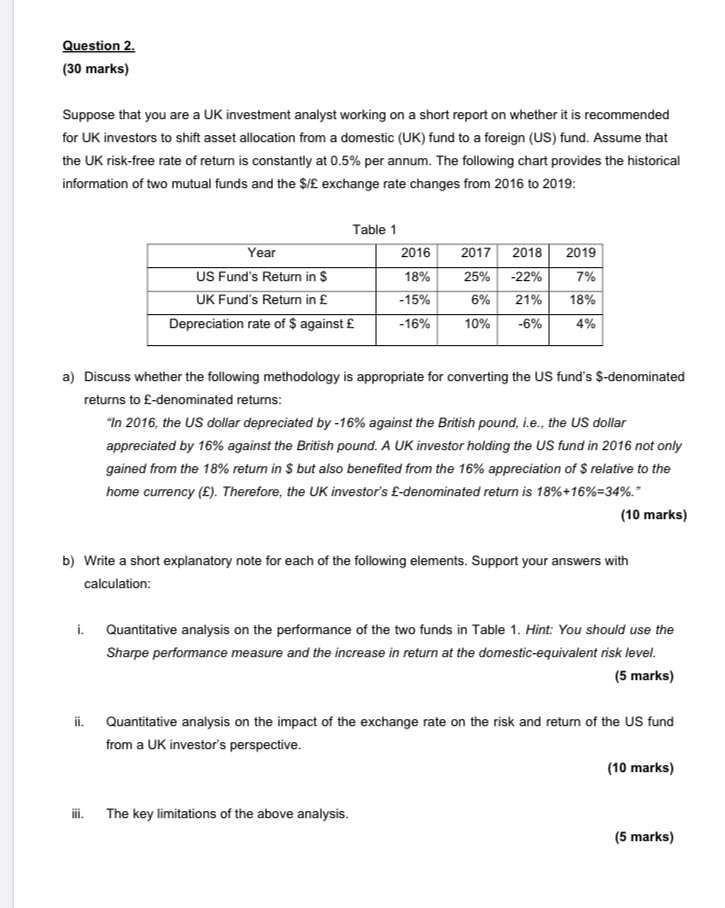

Question 2. (30 marks) Suppose that you are a UK investment analyst working on a short report on whether it is recommended for UK investors to shift asset allocation from a domestic (UK) fund to a foreign (US) fund. Assume that the UK risk-free rate of return is constantly at 0.5% per annum. The following chart provides the historical information of two mutual funds and the $/ exchange rate changes from 2016 to 2019: Table 1 Year US Fund's Return in S UK Fund's Return in Depreciation rate of $ against 2016 18% -15% -16% a) Discuss whether the following methodology is appropriate for converting the US fund's $-denominated returns to -denominated returns: iii. 2017 2018 2019 25% -22% 7% 6% 21% 18% 10% -6% 4% "In 2016, the US dollar depreciated by -16% against the British pound, i.e., the US dollar appreciated by 16% against the British pound. A UK investor holding the US fund in 2016 not only gained from the 18% return in $ but also benefited from the 16% appreciation of $ relative to the home currency (). Therefore, the UK investor's -denominated return is 18% +16 % -34%.* (10 marks) b) Write a short explanatory note for each of the following elements. Support your answers with calculation: i. Quantitative analysis on the performance of the two funds in Table 1. Hint: You should use the Sharpe performance measure and the increase in return at the domestic-equivalent risk level. (5 marks) The key limitations of the above analysis. ii. Quantitative analysis on the impact of the exchange rate on the risk and return of the US fund from a UK investor's perspective. (10 marks) (5 marks)

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

aThe methodology is not appropriate for converting the US funds denominated returns to Edenominated returns The reason is that the return in and the a... View full answer

Get step-by-step solutions from verified subject matter experts