Question: Question 2 (34 Marks) To start your career development immediately after your BBA undergraduate graduation, your first job is employed as an Assistant Financial Analyst

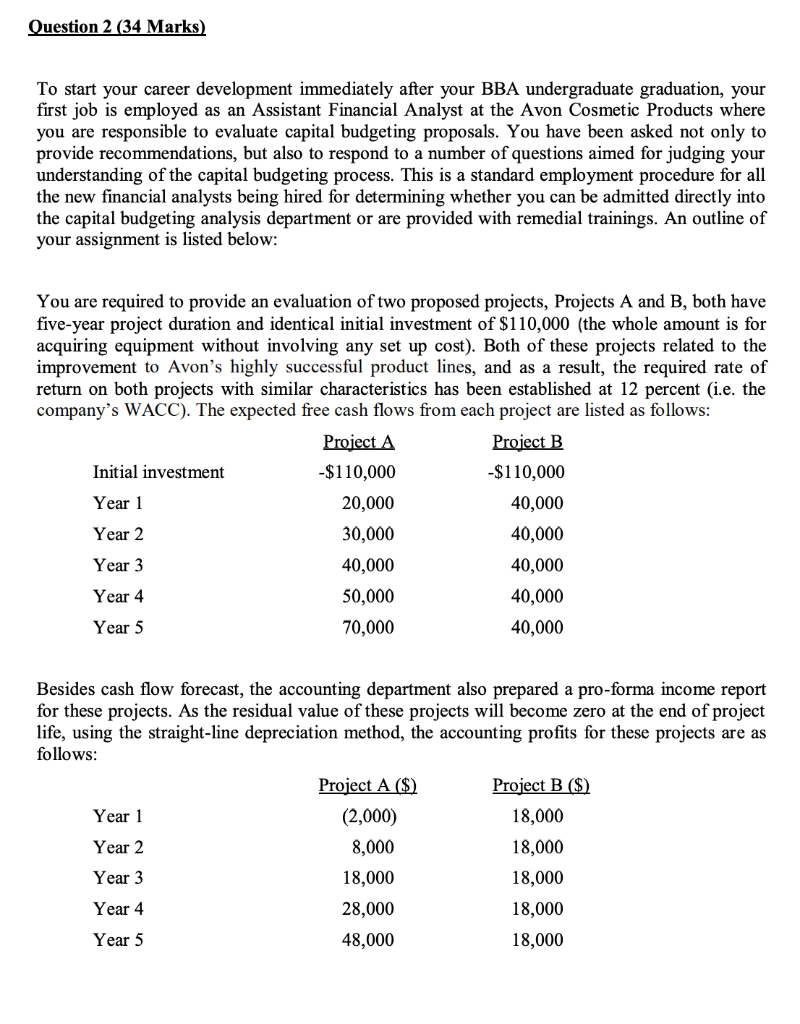

Question 2 (34 Marks) To start your career development immediately after your BBA undergraduate graduation, your first job is employed as an Assistant Financial Analyst at the Avon Cosmetic Products where you are responsible to evaluate capital budgeting proposals. You have been asked not only to provide recommendations, but also to respond to a number of questions aimed for judging your understanding of the capital budgeting process. This is a standard employment procedure for all the new financial analysts being hired for determining whether you can be admitted directly into the capital budgeting analysis department or are provided with remedial trainings. An outline of your assignment is listed below: You are required to provide an evaluation of two proposed projects, Projects A and B, both have five-year project duration and identical initial investment of $110,000 (the whole amount is for acquiring equipment without involving any set up cost). Both of these projects related to the improvement to Avon's highly successful product lines, and as a result, the required rate of return on both projects with similar characteristics has been established at 12 percent (i.e. the company's WACC). The expected free cash flows from each project are listed as follows: Project A Project B Initial investment -$110,000 -$110,000 Year 1 20,000 40,000 Year 2 30,000 40,000 Year 3 40,000 40,000 Year 4 50,000 40,000 Year 5 70,000 40,000 Besides cash flow forecast, the accounting department also prepared a pro-forma income report for these projects. As the residual value of these projects will become zero at the end of project life, using the straight-line depreciation method, the accounting profits for these projects are as follows: Project A ($) Project B ($) Year 1 (2,000) 18,000 Year 2 8,000 18,000 Year 3 18,000 18,000 Year 4 28,000 18,000 Year 5 48,000 18,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts