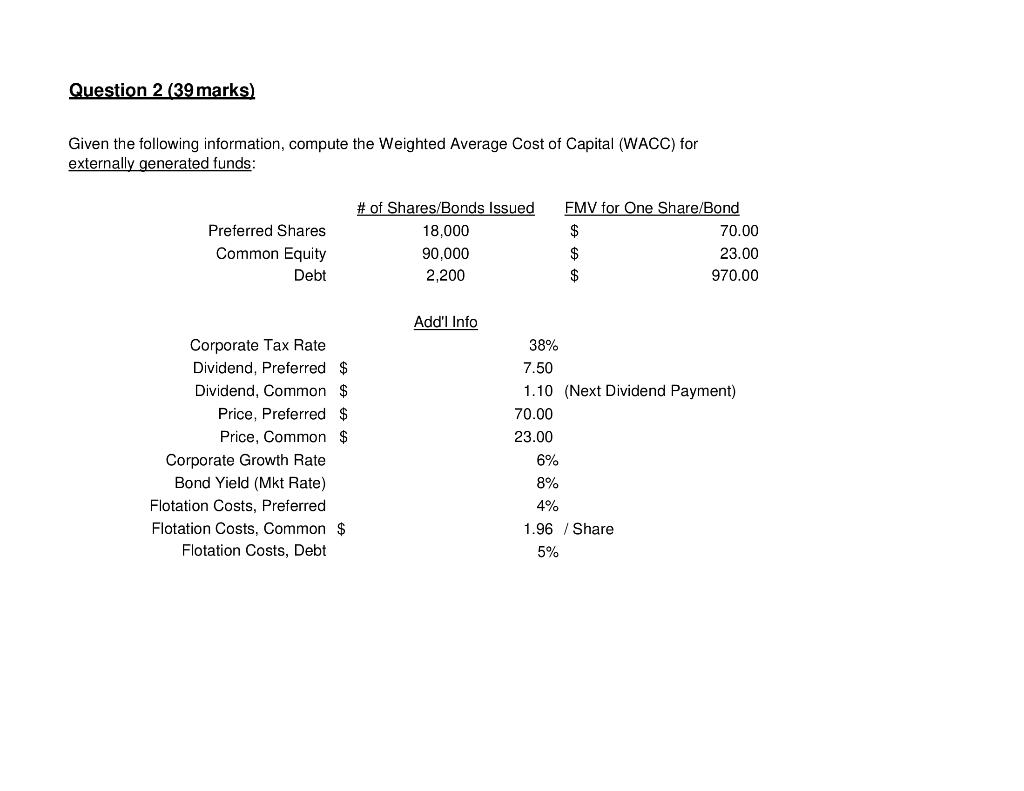

Question: Question 2 (39 marks) Given the following information, compute the Weighted Average Cost of Capital (WACC) for externally generated funds: Preferred Shares Common Equity Debt

Question 2 (39 marks) Given the following information, compute the Weighted Average Cost of Capital (WACC) for externally generated funds: Preferred Shares Common Equity Debt # of Shares/Bonds Issued 18,000 90,000 2,200 FMV for One Share/Bond $ 70.00 $ 23.00 $ 970.00 Add'l Info Corporate Tax Rate Dividend, Preferred $ Dividend, Common $ Price, Preferred $ Price, Common $ Corporate Growth Rate Bond Yield (Mkt Rate) Flotation Costs, Preferred Flotation Costs. Common $ Flotation Costs, Debt 38% 7.50 1.10 (Next Dividend Payment) 70.00 23.00 6% 8% 4% 1.96 / Share 5% Question 2 (39 marks) Given the following information, compute the Weighted Average Cost of Capital (WACC) for externally generated funds: Preferred Shares Common Equity Debt # of Shares/Bonds Issued 18,000 90,000 2,200 FMV for One Share/Bond $ 70.00 $ 23.00 $ 970.00 Add'l Info Corporate Tax Rate Dividend, Preferred $ Dividend, Common $ Price, Preferred $ Price, Common $ Corporate Growth Rate Bond Yield (Mkt Rate) Flotation Costs, Preferred Flotation Costs. Common $ Flotation Costs, Debt 38% 7.50 1.10 (Next Dividend Payment) 70.00 23.00 6% 8% 4% 1.96 / Share 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts