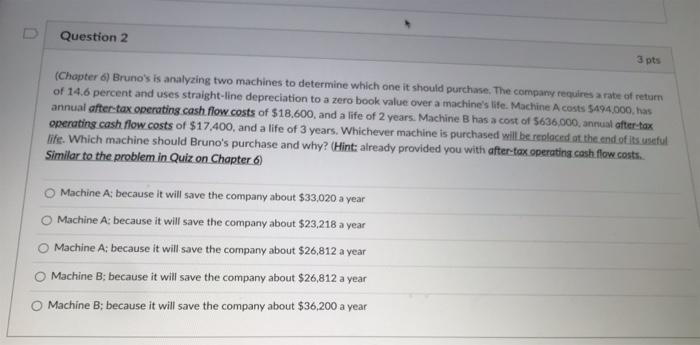

Question: Question 2 3pts (Chapter 6) Bruno's is analyzing two machines to determine which one it should purchase. The company requires a rate of retum of

Question 2 3pts (Chapter 6) Bruno's is analyzing two machines to determine which one it should purchase. The company requires a rate of retum of 14.6 percent and uses straight-line depreciation to a zero book value over a machine's life. Machine A costs $494,000 has annual after tax operating cash flow costs of $18,600, and a life of 2 years. Machine B has a cost of $636,000, annual after tax operating cash flow costs of $17.400, and a life of 3 years. Whichever machine is purchased will be replaced at the end of its useful life. Which machine should Bruno's purchase and why? (Hint: already provided you with after-tax operating cash flow costs. Similar to the problem in Quiz on Chapter 6) Machine A; because it will save the company about $33,020 a year Machine A: because it will save the company about $23,218 a year Machine A: because it will save the company about $26,812 a year Machine B; because it will save the company about $26,812 a year Machine B; because it will save the company about $36,200 a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts