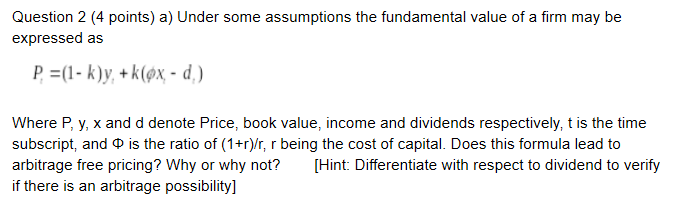

Question: Question 2 (4 points) a) Under some assumptions the fundamental value of a firm may be expressed as P. =(1-k)y, +k(ex- d) Where P, y,

Question 2 (4 points) a) Under some assumptions the fundamental value of a firm may be expressed as P. =(1-k)y, +k(ex- d) Where P, y, x and d denote Price, book value, income and dividends respectively, t is the time subscript, and is the ratio of (1+r)/r, r being the cost of capital. Does this formula lead to arbitrage free pricing? Why or why not? [Hint: Differentiate with respect to dividend to verify if there is an arbitrage possibility] Question 2 (4 points) a) Under some assumptions the fundamental value of a firm may be expressed as P. =(1-k)y, +k(ex- d) Where P, y, x and d denote Price, book value, income and dividends respectively, t is the time subscript, and is the ratio of (1+r)/r, r being the cost of capital. Does this formula lead to arbitrage free pricing? Why or why not? [Hint: Differentiate with respect to dividend to verify if there is an arbitrage possibility]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts