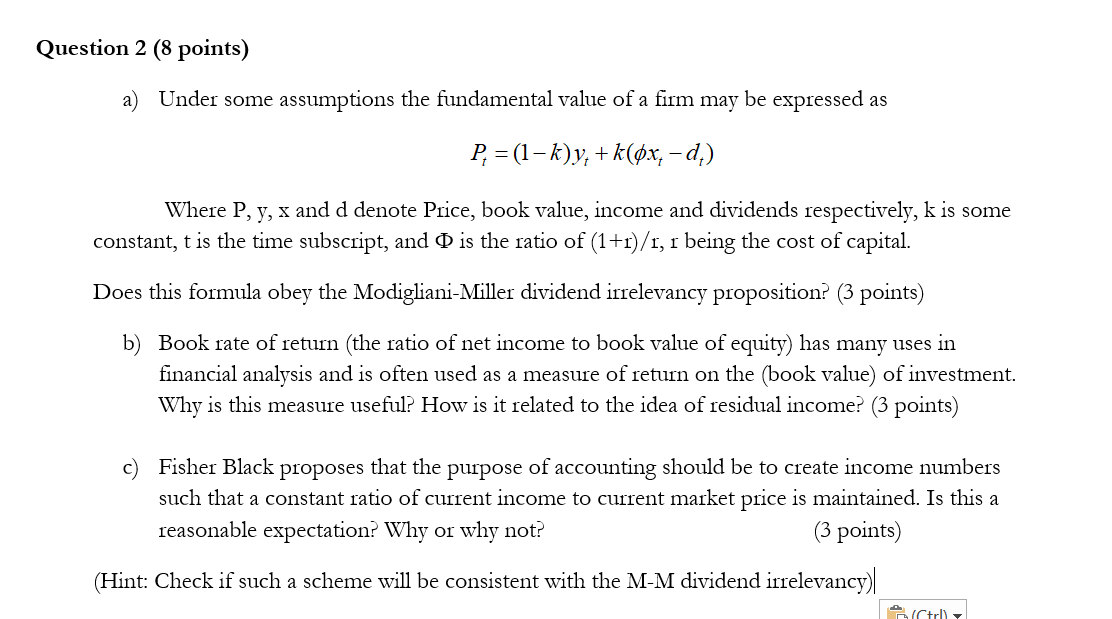

Question: Question 2 (8 points) a) Under some assumptions the fundamental value of a firm may be expressed as P1 = (1 k)y, + k($x, -

Question 2 (8 points) a) Under some assumptions the fundamental value of a firm may be expressed as P1 = (1 k)y, + k($x, - d.) Where P, y, x and d denote Price, book value, income and dividends respectively, k is some constant, t is the time subscript, and Q is the ratio of (1+1)/1, 1 being the cost of capital. Does this formula obey the Modigliani-Miller dividend irrelevancy proposition? (3 points) b) Book rate of return (the ratio of net income to book value of equity) has many uses in financial analysis and is often used as a measure of return on the (book value) of investment. Why is this measure useful? How is it related to the idea of residual income? (3 points) c) Fisher Black proposes that the purpose of accounting should be to create income numbers such that a constant ratio of current income to current market price is maintained. Is this a reasonable expectation? Why or why not? (3 points) (Hint: Check if such a scheme will be consistent with the M-M dividend irrelevancy)| ICtrl) Question 2 (8 points) a) Under some assumptions the fundamental value of a firm may be expressed as P1 = (1 k)y, + k($x, - d.) Where P, y, x and d denote Price, book value, income and dividends respectively, k is some constant, t is the time subscript, and Q is the ratio of (1+1)/1, 1 being the cost of capital. Does this formula obey the Modigliani-Miller dividend irrelevancy proposition? (3 points) b) Book rate of return (the ratio of net income to book value of equity) has many uses in financial analysis and is often used as a measure of return on the (book value) of investment. Why is this measure useful? How is it related to the idea of residual income? (3 points) c) Fisher Black proposes that the purpose of accounting should be to create income numbers such that a constant ratio of current income to current market price is maintained. Is this a reasonable expectation? Why or why not? (3 points) (Hint: Check if such a scheme will be consistent with the M-M dividend irrelevancy)| ICtrl)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts