Question: Question 2 (6 marks) After careful analysis, you have determined that a firm's dividends should grow at 2%%. on average. in the foreseeable future. The

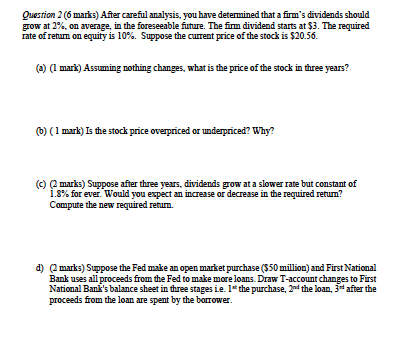

Question 2 (6 marks) After careful analysis, you have determined that a firm's dividends should grow at 2%%. on average. in the foreseeable future. The firm dividend starts at $3. The required rate of return on equity is 10%. Suppose the current price of the stock is $20.56. (a) (1 mark) Assuming nothing changes, what is the price of the stock in three years? (b) ( 1 mark) Is the stock price overpriced or underpriced? Why? (c) (2 marks) Suppose after three years, dividends grow at a slower rate but constant of 1.8% for ever. Would you expect an increase or decrease in the required return? Compute the new required return. d) (2 marks) Suppose the Fed make an open market purchase ($50 million) and First National Bank uses all proceeds from the Fed to make more loans. Draw T-account changes to First National Bank's balance sheet in three stages ie. 1" the purchase, 2nd the loan, 3" after the proceeds from the loan are spent by the borrower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts