Question: Question 2 6,000 The following trial balance was extracted from the accounts of Raven Ltd as at 31 May 2020. Dr Cr Advertising Bank overdraft

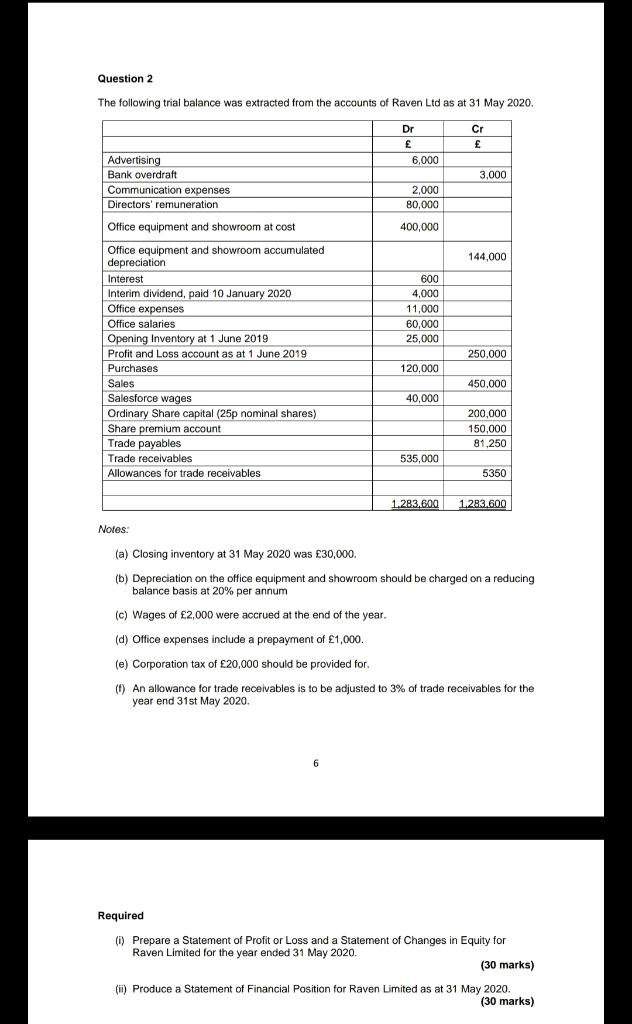

Question 2 6,000 The following trial balance was extracted from the accounts of Raven Ltd as at 31 May 2020. Dr Cr Advertising Bank overdraft 3.000 Communication expenses 2,000 Directors' remuneration 80,000 Office equipment and showroom at cost 400.000 144,000 600 4,000 11.000 60,000 25,000 250,000 Office equipment and showroom accumulated depreciation Interest Interim dividend, paid 10 January 2020 Office expenses Office salaries Opening Inventory at 1 June 2019 Profit and Loss account as at 1 June 2019 Purchases Sales Salesforce wages Ordinary Share capital (25p nominal shares) Share premium account Trade payables Trade receivables Allowances for trade receivables 120,000 450,000 40,000 200,000 150,000 81,250 535,000 5350 1.283.600 1.283.600 Notes: (a) Closing inventory at 31 May 2020 was 30,000. (b) Depreciation on the office equipment and showroom should be charged on a reducing balance basis at 20% per annum (c) Wages of 2,000 were accrued at the end of the year. (d) Office expenses include a prepayment of 1,000. (e) Corporation tax of 20,000 should be provided for. (1) An allowance for trade receivables is to be adjusted to 3% of trade receivables for the year end 31st May 2020. 6 Required (1) Prepare a Statement of Profit or Loss and a Statement of Changes in Equity for Raven Limited for the year ended 31 May 2020. (30 marks) (ii) Produce a Statement of Financial Position for Raven Limited as at 31 May 2020. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts