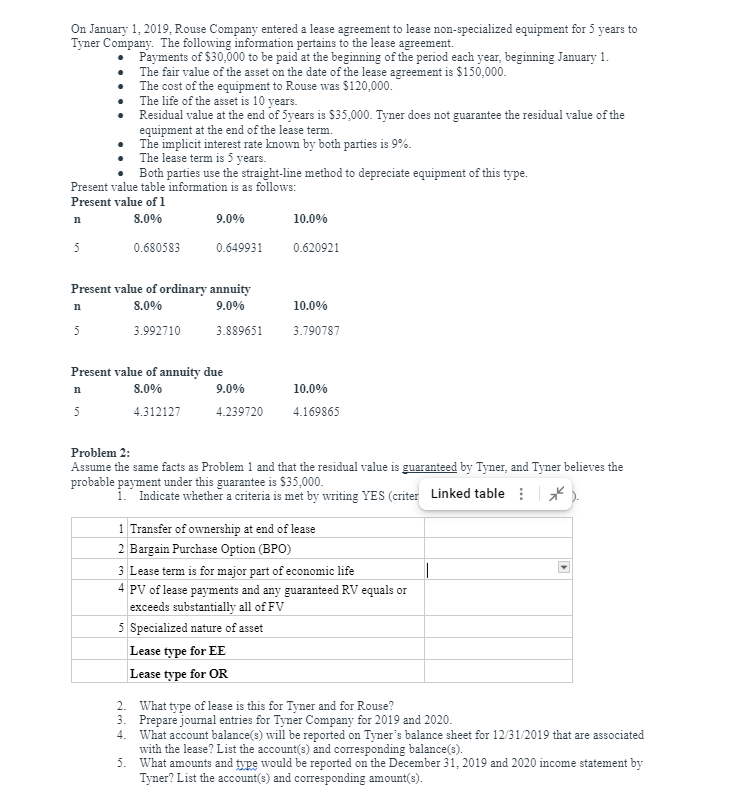

Question: Question 2 On January- I 201 g, Rouse Company entered a lease agreement to lease non-specialized equipment for years to Tyner Companv. The follcnving information

On January- I 201 g, Rouse Company entered a lease agreement to lease non-specialized equipment for years to Tyner Companv. The follcnving information pertains to the lease agreement Payments of to be paid at the beginning of the period uch veal, beginning January I. The fair value of the asset on the date ofthe lease agreement is SISO,OOO_ The cost of the equipment to Rouse 5120:000. The life of the asset is 10 ve.an_ Residual value at the end of *ears is S3%OOO_ Tyner does not guarantee the residual value ofthe equipment at the end ofthe lease tertu The implicit interest rate knoum by both parties is The lease term is vears. Both parties use the straight-line method to depreciate equipment of this Present value table information is as follows: Present value of I 9.0% Present value of ordinary annuity 9.0% Present value of annuitv due 9.0% 4.239720 Pmblem 2: 10.0% 0.620921 10.0% 10.0% Assume the same facts Problem I and that the residual value is by Tyner, and Tyner believes the probable payment urder this guarantee is SS 5:000_ a criteria is met by writing YES (crite Linked table I Transfer of ownership at end of lease 2 Bargain Purchase Option (EPO) 3 Lease term is for major part of economic life 4 PV of lease payments ard any guaranteed RV equals or exceeds substantiallv all of FV _f Specialized nature of asset Lease type for EE Lease type for OR of lease is this for Tyner and for Rouge? Prepare jumzl entries for Tyner Company for 201 g and 2020. accunt halance(s) will be reported on Tyner's balance sheet for 12'31;2019 that are associated with the lease? List the account(s) and corresponding amounts and would be reported on the December 31, 20 tg and 2020 income statement by Tyner? List the and correponding amunt(sI On January- I 201 g, Rouse Company entered a lease agreement to lease non-specialized equipment for years to Tyner Companv. The follcnving information pertains to the lease agreement Payments of to be paid at the beginning of the period uch veal, beginning January I. The fair value of the asset on the date ofthe lease agreement is SISO,OOO_ The cost of the equipment to Rouse 5120:000. The life of the asset is 10 ve.an_ Residual value at the end of *ears is S3%OOO_ Tyner does not guarantee the residual value ofthe equipment at the end ofthe lease tertu The implicit interest rate knoum by both parties is The lease term is vears. Both parties use the straight-line method to depreciate equipment of this Present value table information is as follows: Present value of I 9.0% Present value of ordinary annuity 9.0% Present value of annuitv due 9.0% 4.239720 Pmblem 2: 10.0% 0.620921 10.0% 10.0% Assume the same facts Problem I and that the residual value is by Tyner, and Tyner believes the probable payment urder this guarantee is SS 5:000_ a criteria is met by writing YES (crite Linked table I Transfer of ownership at end of lease 2 Bargain Purchase Option (EPO) 3 Lease term is for major part of economic life 4 PV of lease payments ard any guaranteed RV equals or exceeds substantiallv all of FV _f Specialized nature of asset Lease type for EE Lease type for OR of lease is this for Tyner and for Rouge? Prepare jumzl entries for Tyner Company for 201 g and 2020. accunt halance(s) will be reported on Tyner's balance sheet for 12'31;2019 that are associated with the lease? List the account(s) and corresponding amounts and would be reported on the December 31, 20 tg and 2020 income statement by Tyner? List the and correponding amunt(sI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts