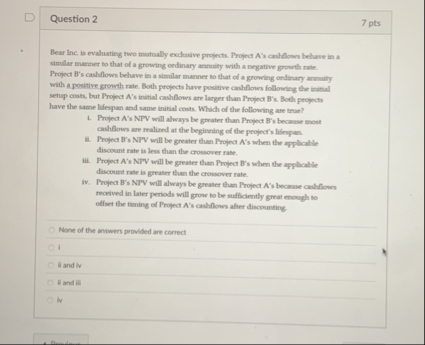

Question: Question 2 7 pts Bear lnc . is evaluating two matually exclusive propects. Project A ' s cashfows behave in a simalar marner to that

Question

pts

Bear lnc is evaluating two matually exclusive propects. Project As cashfows behave in a simalar marner to that of a growing ordinary anmuity with a negative growth rate. Tropact Wiscis flows behave in a sumular manner to that of a growing ordmary anauiy with a positive grometh rate. Both profects have positive cashflows followings the initial sehup costs, but Profect As insitial cashAlows are larger than Propect Bs Both projects have the same lifespan and same initial costs. Whath of the following are trae?

Profoct As NTV mill ahways be greater than Propect Bs becanse most cashflows are realined at the leginning of the peofect's lifespan.

ii Projear Bs NPV will be greater than Project As when the applicable discount rate is less than the crossover rate.

tIt. Mrofoct As NTV witt be greaser then Propect Bs when the applable discoumt rate is greater than the crossover rate.

iv Project Bs NPV will always be greater than Project As because cashboes received in later periods will grow to be sulficiently great enough to efleet the thintrg of Troport i cat thons alier discoounting

None of the anowers provided are correct

II and iv

IT andiir

iv

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock