Question

On 01-07-2016, Mr. X Invested 50,000/- at initial offer in Mutual Funds at a face value of 10 each per unit. On 31-03-2017, a

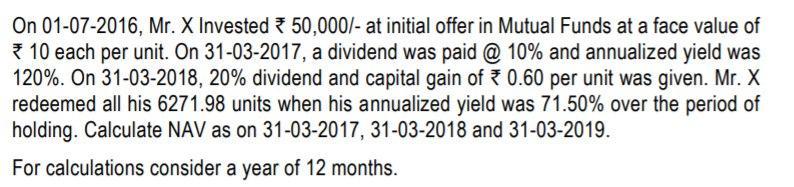

On 01-07-2016, Mr. X Invested 50,000/- at initial offer in Mutual Funds at a face value of 10 each per unit. On 31-03-2017, a dividend was paid @ 10% and annualized yield was 120%. On 31-03-2018, 20% dividend and capital gain of * 0.60 per unit was given. Mr. X redeemed all his 6271.98 units when his annualized yield was 71.50% over the period of holding. Calculate NAV as on 31-03-2017, 31-03-2018 and 31-03-2019. For calculations consider a year of 12 months.

Step by Step Solution

3.39 Rating (127 Votes )

There are 3 Steps involved in it

Step: 1

Number of units in the beginning 5000010 5000 units Yield for 9 months 120912 90 Market value o...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

14th Edition

1260247821, 978-1260247824

Students also viewed these Organizational Behavior questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App