Question: QUESTION 2 (8 Marks) From the information given below match each question with the correct answer. You have to round off to the second decimal.

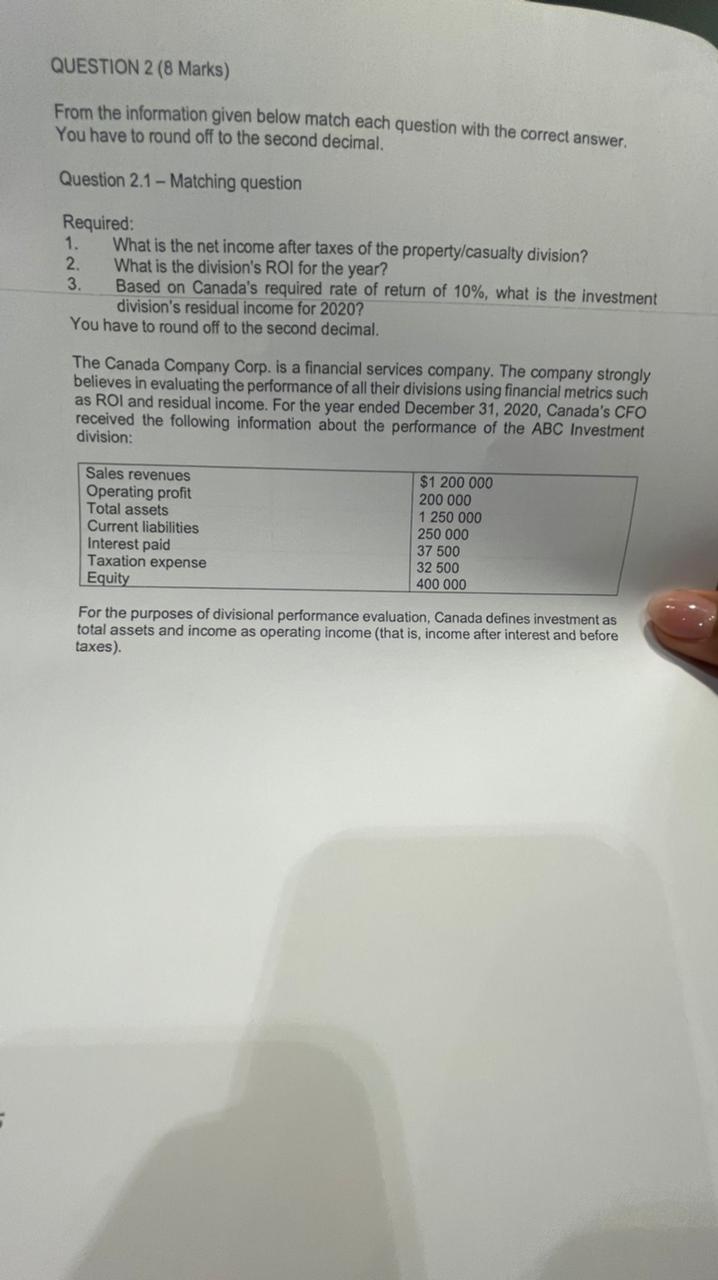

QUESTION 2 (8 Marks) From the information given below match each question with the correct answer. You have to round off to the second decimal. Question 2.1 - Matching question Required: 1. What is the net income after taxes of the property/casualty division? 2. What is the division's ROI for the year? 3. Based on Canada's required rate of return of 10%, what is the investment division's residual income for 2020? You have to round off to the second decimal. The Canada Company Corp. is a financial services company. The company strongly believes in evaluating the performance of all their divisions using financial metrics such as ROI and residual income. For the year ended December 31, 2020, Canada's CFO received the following information about the performance of the ABC Investment division: Sales revenues Operating profit Total assets Current liabilities Interest paid Taxation expense Equity $1 200 000 200 000 1 250 000 250 000 37 500 32 500 400 000 For the purposes of divisional performance evaluation, Canada defines investment as total assets and income as operating income (that is, income after interest and before taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts