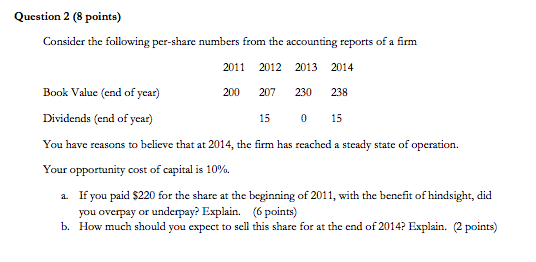

Question: Question 2 (8 points) Consider the following per-share numbers from the accounting reports of a firm 2011 2012 2013 2014 Book Value (end of year)

Question 2 (8 points) Consider the following per-share numbers from the accounting reports of a firm 2011 2012 2013 2014 Book Value (end of year) 200 207 230 238 Dividends (end of year) 15 15 You have reasons to believe that at 2014, the firm has reached a steady state of operation. Your opportunity cost of capital is 10%. a If you paid $220 for the share at the beginning of 2011, with the benefit of hindsight, did you overpay or underpay? Explain. (6 points) b. How much should you expect to sell this share for at the end of 2014? Explain. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts