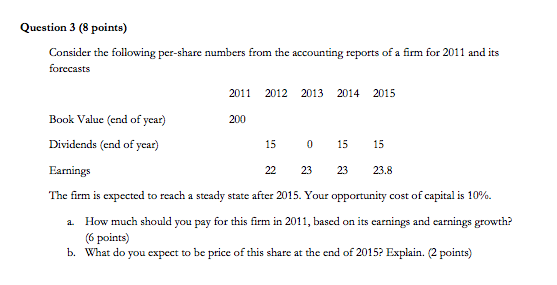

Question: Question 3 (8 points) Consider the following per-share numbers from the accounting reports of a firm for 2011 and its forecasts 2011 2012 2013 2014

Question 3 (8 points) Consider the following per-share numbers from the accounting reports of a firm for 2011 and its forecasts 2011 2012 2013 2014 2015 Book Value (end of year) 200 Dividends (end of year) 15 0 15 15 Earnings 22 23 23 23.8 The firm is expected to reach a steady state after 2015. Your opportunity cost of capital is 10%. 2. How much should you pay for this firm in 2011, based on its earnings and earnings growth? (6 points) b. What do you expect to be price of this share at the end of 2015? Explain. 2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts