Question: Question 2 a) A start-up company needs additional capital. The company has currently not made a profit and requires substantial amounts of investment to launch

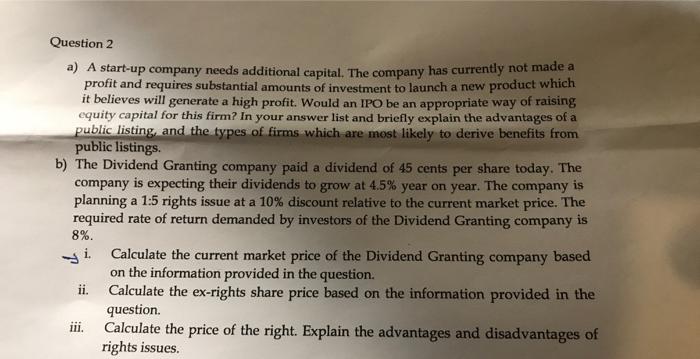

Question 2 a) A start-up company needs additional capital. The company has currently not made a profit and requires substantial amounts of investment to launch a new product which it believes will generate a high profit. Would an IPO be an appropriate way of raising equity capital for this firm? In your answer list and briefly explain the advantages of a public listing, and the types of firms which are most likely to derive benefits from public listings. b) The Dividend Granting company paid a dividend of 45 cents per share today. The company is expecting their dividends to grow at 4.5% year on year. The company is planning a 1:5 rights issue at a 10% discount relative to the current market price. The required rate of return demanded by investors of the Dividend Granting company is 8%. ii. Calculate the current market price of the Dividend Granting company based on the information provided in the question. Calculate the ex-rights share price based on the information provided in the question Calculate the price of the right. Explain the advantages and disadvantages of rights issues. ill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts