Question: Question 2 a) A start-up company needs additional capital. The company has currently not made a profit and requires substantial amounts of investment to launch

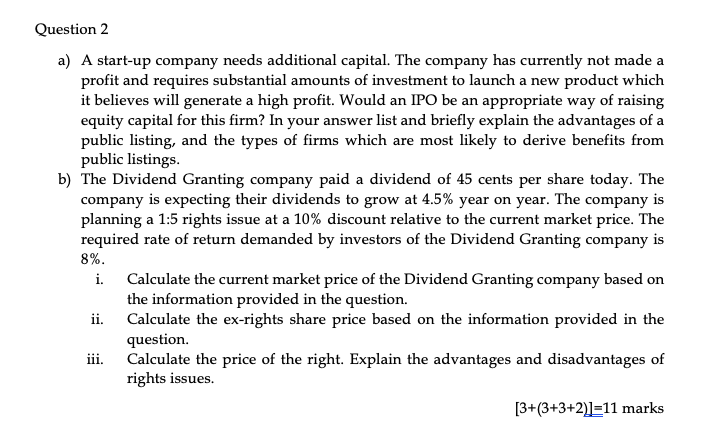

Question 2 a) A start-up company needs additional capital. The company has currently not made a profit and requires substantial amounts of investment to launch a new product which it believes will generate a high profit. Would an IPO be an appropriate way of raising equity capital for this firm? In your answer list and briefly explain the advantages of a public listing, and the types of firms which are most likely to derive benefits from public listings. b) The Dividend Granting company paid a dividend of 45 cents per share today. The company is expecting their dividends to grow at 4.5% year on year. The company is planning a 1:5 rights issue at a 10% discount relative to the current market price. The required rate of return demanded by investors of the Dividend Granting company is 8%. i. Calculate the current market price of the Dividend Granting company based on the information provided in the question. ii. Calculate the ex-rights share price based on the information provided in the question. iii. Calculate the price of the right. Explain the advantages and disadvantages of rights issues. [3+(3+3+2)]=11 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts