Question: Question 2 (a) ABC Company owns a CNC machine that t is considering for replacement. Its current market value is $25,000, but it can be

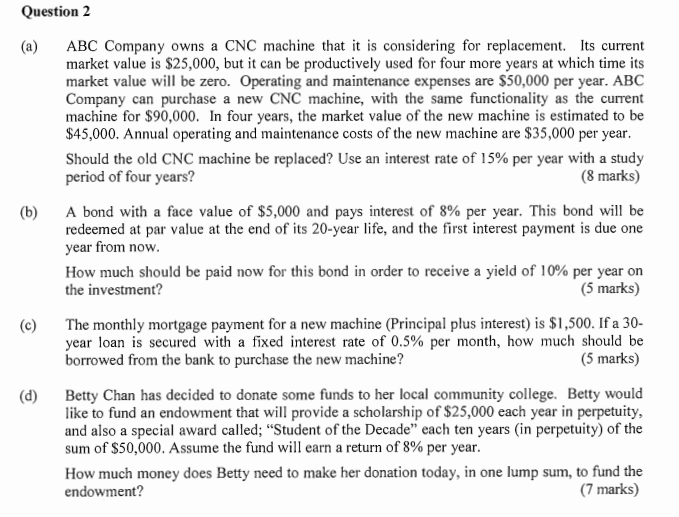

Question 2 (a) ABC Company owns a CNC machine that t is considering for replacement. Its current market value is $25,000, but it can be productively used for four more years at which time its market value will be zero. Operating and maintenance expenses are $50,000 per year. ABC Company can purchase a new CNC machine, with the same functionality as the current machine for $90,000. In four years, the market value of the new machine is estimated to be $45,000. Annual operating and maintenance costs of the new machine are $35,000 per year Should the old CNC machine be replaced? Use an interest rate of 15% per year with a study period of four years? (8 marks) A bond with a face value of $5,000 and pays interest of 8% per year. This bond will be redeemed at par value at the end of its 20-year life, and the first interest payment is due one year firom nOW (b) How much should be paid now for this bond in order to receive a yield of 10% per year on the investment? (5 marks) The monthly mortgage payment for a new machine (Principal plus interest) is $1,500. If a 30- year loan is secured with a fixed interest rate of 0.5% per month, how much should be borrowed from the bank to purchase the new machine? (c) (5 marks) Betty Chan has decided to donate some funds to her local community college. Betty would like to fund an endowment that will provide a scholarship of $25,000 each year in perpetuity, and also a special award called; "Student of the Decade" each ten years (in perpetuity) of the sum of $50,000. Assume the fund will earn a return of 8% per year (d) How much money does Betty need to make her donation today, in one lump sum, to fund the endowment? (7 marks) Question 2 (a) ABC Company owns a CNC machine that t is considering for replacement. Its current market value is $25,000, but it can be productively used for four more years at which time its market value will be zero. Operating and maintenance expenses are $50,000 per year. ABC Company can purchase a new CNC machine, with the same functionality as the current machine for $90,000. In four years, the market value of the new machine is estimated to be $45,000. Annual operating and maintenance costs of the new machine are $35,000 per year Should the old CNC machine be replaced? Use an interest rate of 15% per year with a study period of four years? (8 marks) A bond with a face value of $5,000 and pays interest of 8% per year. This bond will be redeemed at par value at the end of its 20-year life, and the first interest payment is due one year firom nOW (b) How much should be paid now for this bond in order to receive a yield of 10% per year on the investment? (5 marks) The monthly mortgage payment for a new machine (Principal plus interest) is $1,500. If a 30- year loan is secured with a fixed interest rate of 0.5% per month, how much should be borrowed from the bank to purchase the new machine? (c) (5 marks) Betty Chan has decided to donate some funds to her local community college. Betty would like to fund an endowment that will provide a scholarship of $25,000 each year in perpetuity, and also a special award called; "Student of the Decade" each ten years (in perpetuity) of the sum of $50,000. Assume the fund will earn a return of 8% per year (d) How much money does Betty need to make her donation today, in one lump sum, to fund the endowment? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts