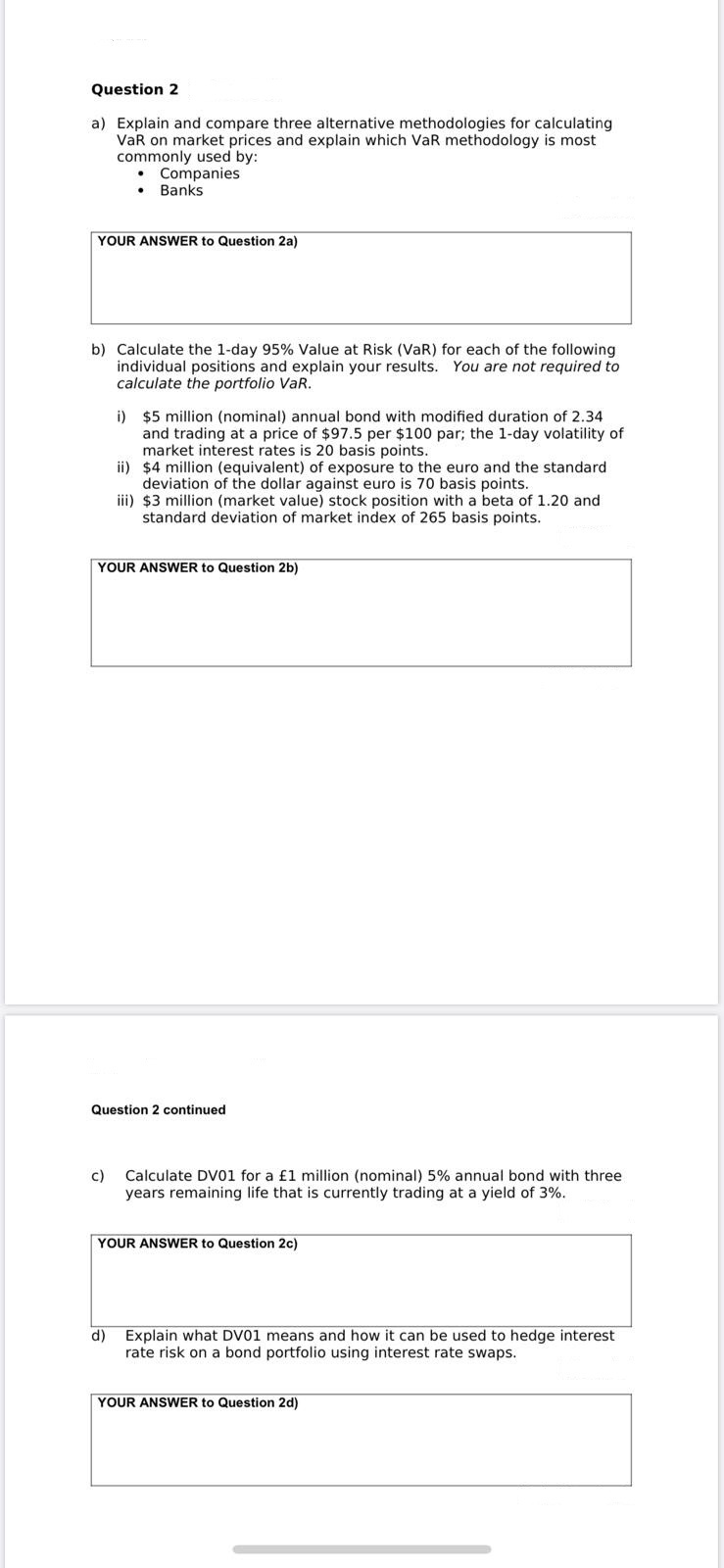

Question: Question 2 a) Explain and compare three alternative methodologies for calculating VaR on market prices and explain which VaR methodology is most commonly used by:

Question 2 a) Explain and compare three alternative methodologies for calculating VaR on market prices and explain which VaR methodology is most commonly used by: Companies Banks YOUR ANSWER to Question 2a) b) Calculate the 1-day 95% Value at Risk (VaR) for each of the following individual positions and explain your results. You are not required to calculate the portfolio VaR. i) $5 million (nominal) annual bond with modified duration of 2.34 and trading at a price of $97.5 per $100 par; the 1-day volatility of market interest rates is 20 basis points. ii) $4 million (equivalent) of exposure to the euro and the standard deviation of the dollar against euro is 70 basis points. iii) $3 million (market value) stock position with a beta of 1.20 and standard deviation of market index of 265 basis points. YOUR ANSWER to Question 2b) Question 2 continued c) Calculate DV01 for a 1 million (nominal) 5% annual bond with three years remaining life that is currently trading at a yield of 3%. YOUR ANSWER to Question 2c) d) Explain what DV01 means and how it can be used to hedge interest rate risk on a bond portfolio using interest rate swaps. YOUR ANSWER to Question 2d) Question 2 a) Explain and compare three alternative methodologies for calculating VaR on market prices and explain which VaR methodology is most commonly used by: Companies Banks YOUR ANSWER to Question 2a) b) Calculate the 1-day 95% Value at Risk (VaR) for each of the following individual positions and explain your results. You are not required to calculate the portfolio VaR. i) $5 million (nominal) annual bond with modified duration of 2.34 and trading at a price of $97.5 per $100 par; the 1-day volatility of market interest rates is 20 basis points. ii) $4 million (equivalent) of exposure to the euro and the standard deviation of the dollar against euro is 70 basis points. iii) $3 million (market value) stock position with a beta of 1.20 and standard deviation of market index of 265 basis points. YOUR ANSWER to Question 2b) Question 2 continued c) Calculate DV01 for a 1 million (nominal) 5% annual bond with three years remaining life that is currently trading at a yield of 3%. YOUR ANSWER to Question 2c) d) Explain what DV01 means and how it can be used to hedge interest rate risk on a bond portfolio using interest rate swaps. YOUR ANSWER to Question 2d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts