Question: Question 2 A firm is considering when to replace the old machine with a new one. The new machine under consideration costs $ 3 8

Question

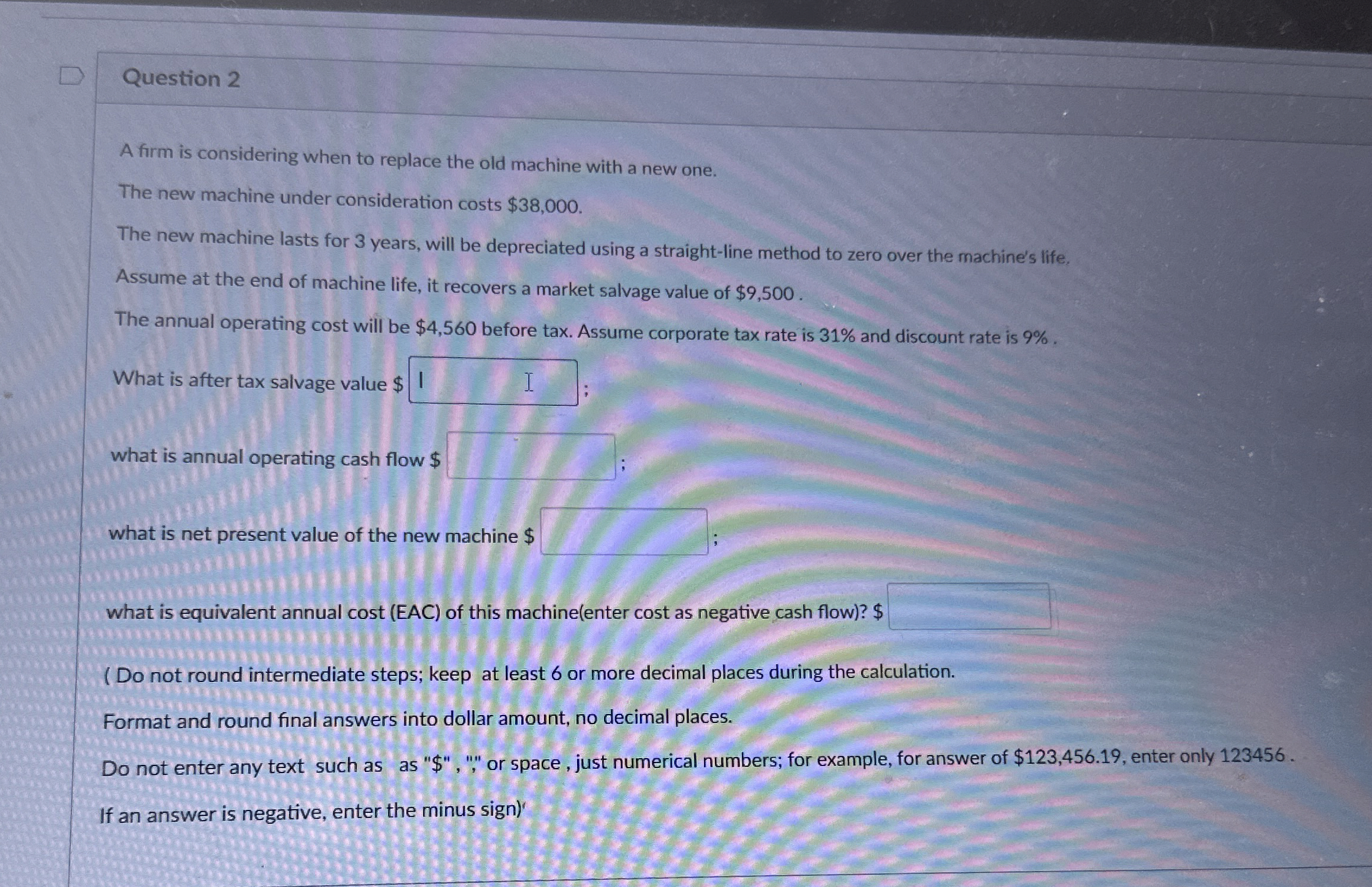

A firm is considering when to replace the old machine with a new one.

The new machine under consideration costs $

The new machine lasts for years, will be depreciated using a straightline method to zero over the machine's life,

Assume at the end of machine life, it recovers a market salvage value of $

The annual operating cost will be $ before tax. Assume corporate tax rate is and discount rate is

What is after tax salvage value $

what is annual operating cash flow $

what is net present value of the new machine $

what is equivalent annual cost EAC of this machineenter cost as negative cash flow $

Do not round intermediate steps; keep at least or more decimal places during the calculation.

Format and round final answers into dollar amount, no decimal places.

Do not enter any text such as as $ or space, just numerical numbers; for example, for answer of $ enter only

If an answer is negative, enter the minus sign

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock