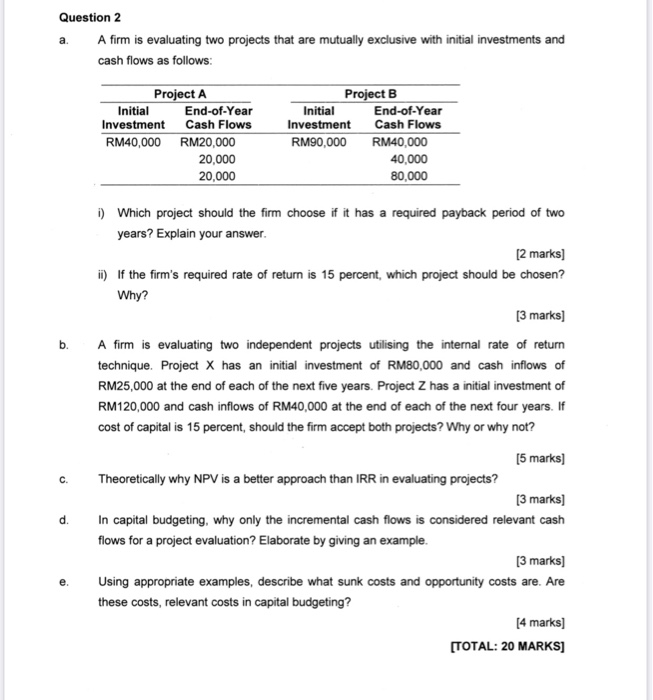

Question: Question 2 A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: Project A Initial End-of-Year Investment

Question 2 A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: Project A Initial End-of-Year Investment Cash Flows RM40,000 RM20,000 20,000 20,000 Project B Initial End-of-Year Investment Cash Flows RM90,000 RM40,000 40,000 80,000 i). Which project should the firm choose if it has a required payback period of two years? Explain your answer. [2 marks] ii) If the firm's required rate of return is 15 percent, which project should be chosen? Why? [3 marks] A firm is evaluating two independent projects utilising the internal rate of return technique. Project X has an initial investment of RM80,000 and cash inflows of RM25,000 at the end of each of the next five years. Project Z has a initial investment of RM120,000 and cash inflows of RM40,000 at the end of each of the next four years. If cost of capital is 15 percent, should the firm accept both projects? Why or why not? b. C. d. [5 marks] Theoretically why NPV is a better approach than IRR in evaluating projects? [3 marks] In capital budgeting, why only the incremental cash flows is considered relevant cash flows for a project evaluation? Elaborate by giving an example, [3 marks] Using appropriate examples, describe what sunk costs and opportunity costs are. Are these costs, relevant costs in capital budgeting? [4 marks) [TOTAL: 20 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts