Question: Question 2 (a) Modify the Millers Tax Computation program in Figure 1.2 to include the next higher tax bracket: 28% for earnings between $153,101 and

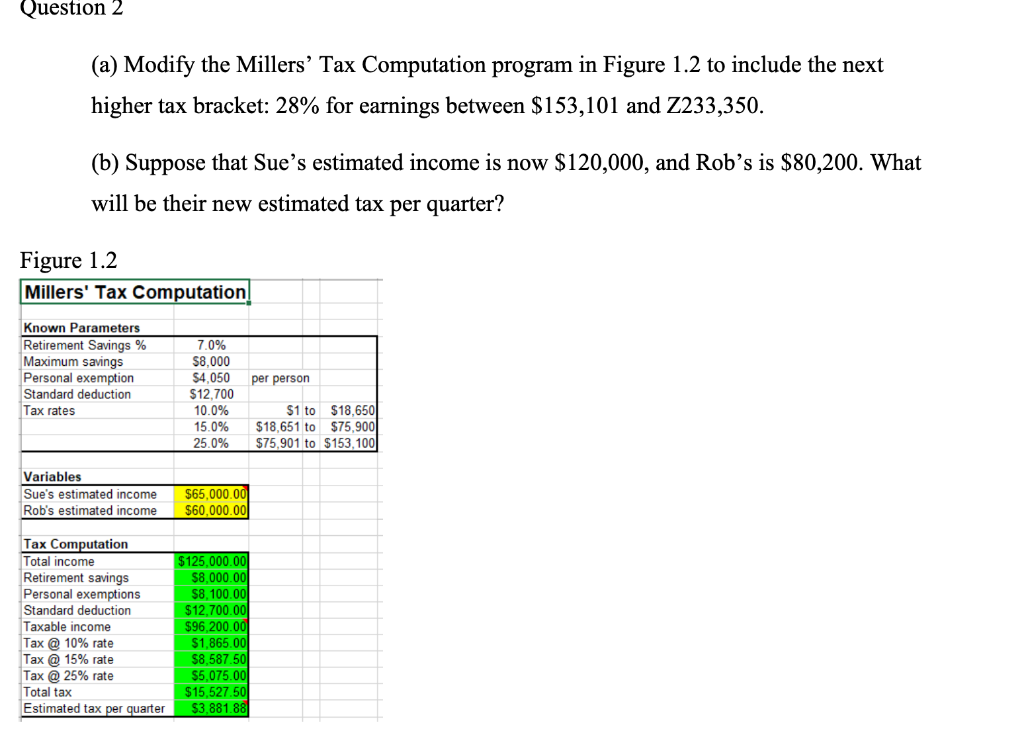

Question 2 (a) Modify the Millers Tax Computation program in Figure 1.2 to include the next higher tax bracket: 28% for earnings between $153,101 and Z233,350. (b) Suppose that Sue's estimated income is now $120,000, and Robs is $80,200. What will be their new estimated tax per quarter? Figure 1.2 Millers' Tax Computation Known Parameters Retirement Savings % Maximum savings Personal exemption Standard deduction Tax rates per person 7.0% $8,000 $4.050 $12,700 10.0% 15.0% 25.0% $1 to $18,650 $18,651 to $75,900 $75,901 to $153,100 Variables Sue's estimated income Rob's estimated income $65,000.00 $60,000.00 savings Tax Computation Total income Retirement Personal exemptions Standard deduction Taxable income Tax @ 10% rate Tax @ 15% rate Tax @ 25% rate Total tax Estimated tax per quarter $125,000.00 $8,000.00 $8,100.00 $12.700.00 $96,200.00 $1,865.00 $8,587.50 $5,075.00 $15,527.50 $3,881.88 Question 2 (a) Modify the Millers Tax Computation program in Figure 1.2 to include the next higher tax bracket: 28% for earnings between $153,101 and Z233,350. (b) Suppose that Sue's estimated income is now $120,000, and Robs is $80,200. What will be their new estimated tax per quarter? Figure 1.2 Millers' Tax Computation Known Parameters Retirement Savings % Maximum savings Personal exemption Standard deduction Tax rates per person 7.0% $8,000 $4.050 $12,700 10.0% 15.0% 25.0% $1 to $18,650 $18,651 to $75,900 $75,901 to $153,100 Variables Sue's estimated income Rob's estimated income $65,000.00 $60,000.00 savings Tax Computation Total income Retirement Personal exemptions Standard deduction Taxable income Tax @ 10% rate Tax @ 15% rate Tax @ 25% rate Total tax Estimated tax per quarter $125,000.00 $8,000.00 $8,100.00 $12.700.00 $96,200.00 $1,865.00 $8,587.50 $5,075.00 $15,527.50 $3,881.88

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock