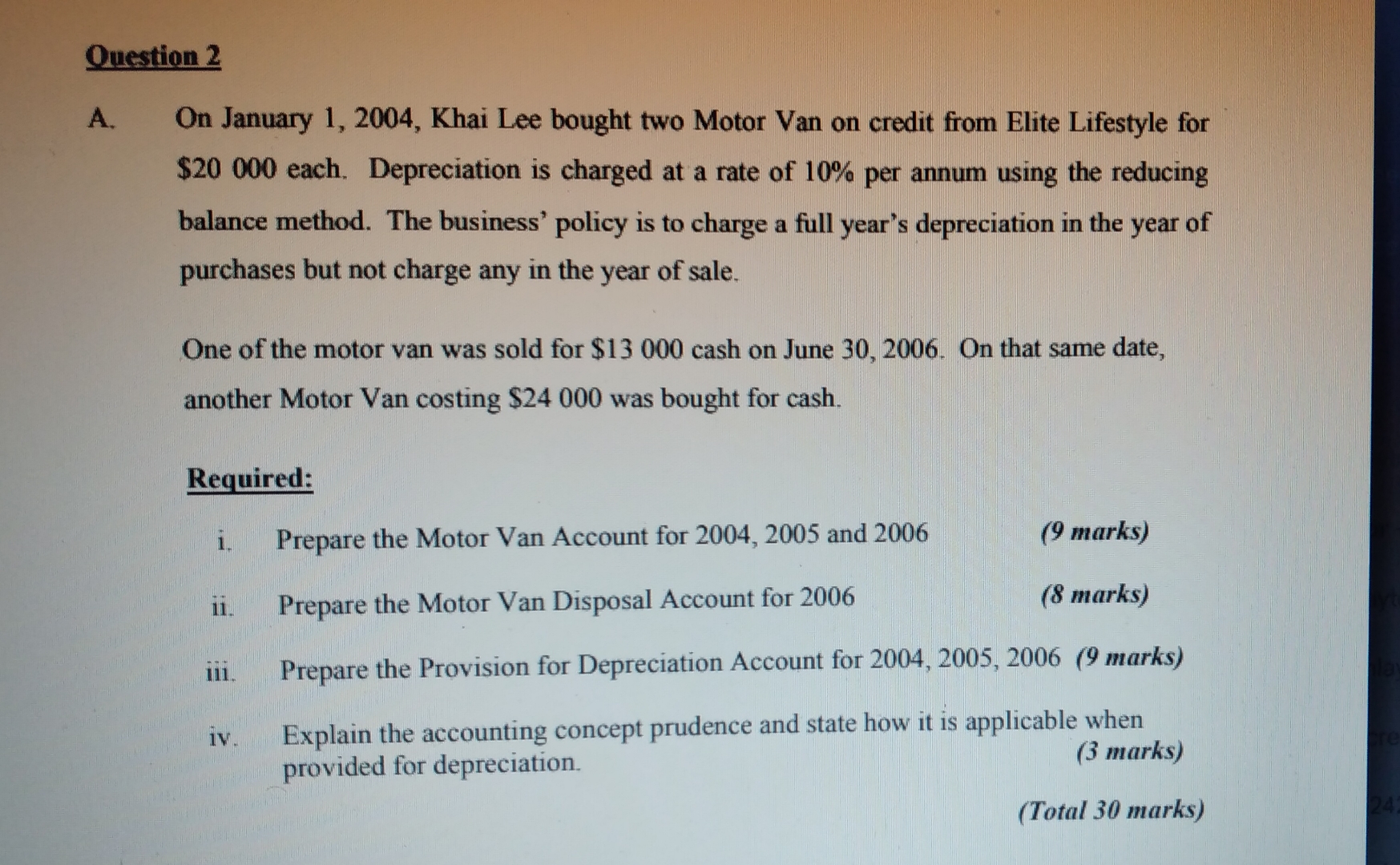

Question: Question 2 A . On January 1 , 2 0 0 4 , Khai Lee bought two Motor Van on credit from Elite Lifestyle for

Question

A On January Khai Lee bought two Motor Van on credit from Elite Lifestyle for $ each. Depreciation is charged at a rate of per annum using the reducing balance method. The business' policy is to charge a full year's depreciation in the year of purchases but not charge any in the year of sale.

One of the motor van was sold for $ cash on June On that same date, another Motor Van costing $ was bought for cash.

Required:

i Prepare the Motor Van Account for and

marks

ii Prepare the Motor Van Disposal Account for

marks

iii. Prepare the Provision for Depreciation Account for marks

iv Explain the accounting concept prudence and state how it is applicable when provided for depreciation.

marks

Total marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock